How Have The 2015 Batch Of Executive Condominiums Performed So Far?

October 9, 2020

In 2012, the first of the 2015 TOP bunch of Executive Condominiums (ECs) went up for sale across the island. It was a bit of a tough time, as 2011 had seen a slew of cooling measures (ABSD introduced); and there were signs that the markets in China could be in for a crash.

Back then, it was often said that executive condominiums would always do well regardless; almost every batch of first-time buyers had made money from their ECs. But as with always in property in Singapore, many people were complaining about the high EC launch prices. Our first entrance on this list, The Tampines Trilliant, only sold about 130 plus units upon launch (out of 670 units).

So now that their MOP has been reached in 2020, here’s a look at these (current or soon to be) resale Executive Condominiums have performed since their completion in 2015:

Which ECs are reaching their MOP in 2020?

In the same manner as HDB flats, Executive Condominiums can only be put on the open market after a five-year MOP. Note that the MOP is calculated from the date of the EC’s completion, not from the date from sale.

These are the developments that are coming up on the resale market now:

- The Tampines Trilliant (on the market)

- The Rainforest (on the market)

- Twin Waterfalls (on the market)

- 1 Canberra (on the market)

- Heron Bay (MOP on 7th October 2020)

- Waterwoods (MOP on 1st December 2020)

Now, let’s take a look at how the first three developments have been selling so far. For Heron Bay and Waterwoods, do follow us on Facebook, and we’ll update their sales figures in a few months following their MOP.

1. The Tampines Trilliant

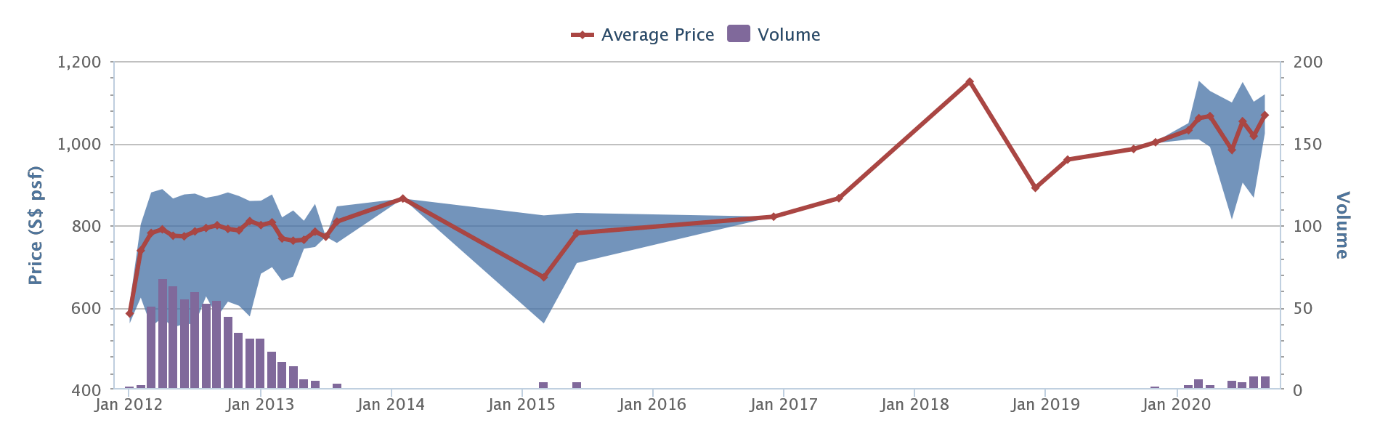

In September 2012, prices at The Tampines Trilliant averaged $800 psf. As of September 2020, this had increased to $1,068 psf. This is an increase of 33.5 per cent, or an annualised return of 3.68 per cent.

To date, there have been 42 profitable transactions recorded, the following being the top five for 2020:

| Date | Size (Sq. Ft.) | Purchase Price (PSF) | Sale Price (PSF) | Profit | Annualised Return |

| 11 Jun 2020 | 2,121 | $575 | $825 | $531,000 | 4.5% |

| 27 Mar 2020 | 1,302 | $816 | $1,152 | $437,000 | 4.5% |

| 12 Jun 2020 | 1,991 | $602 | $814 | $422,000 | 3.8% |

| 7 Aug 2020 | 1,302 | $769 | $1,089 | $418,000 | 4.2% |

| 11 Feb 2020 | 1,302 | $785 | $1,037 | $328,000 | 3.6% |

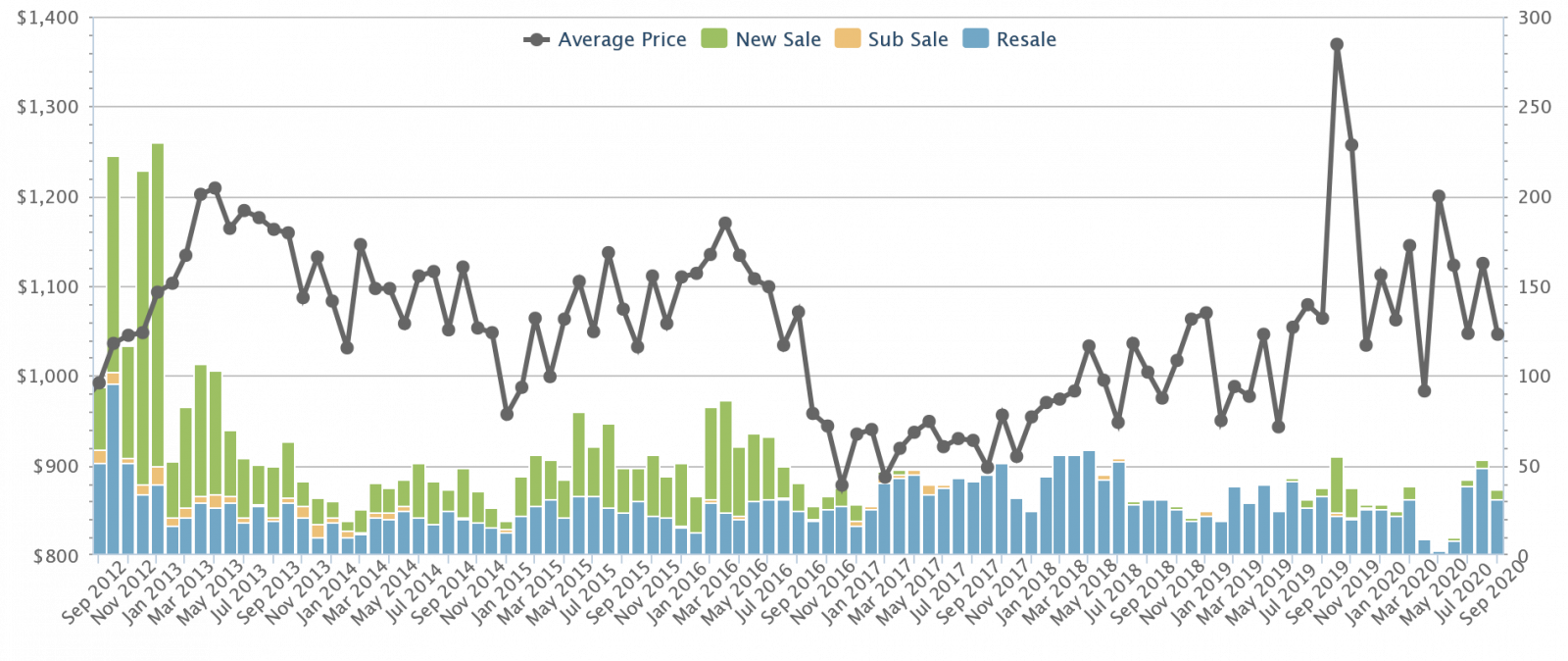

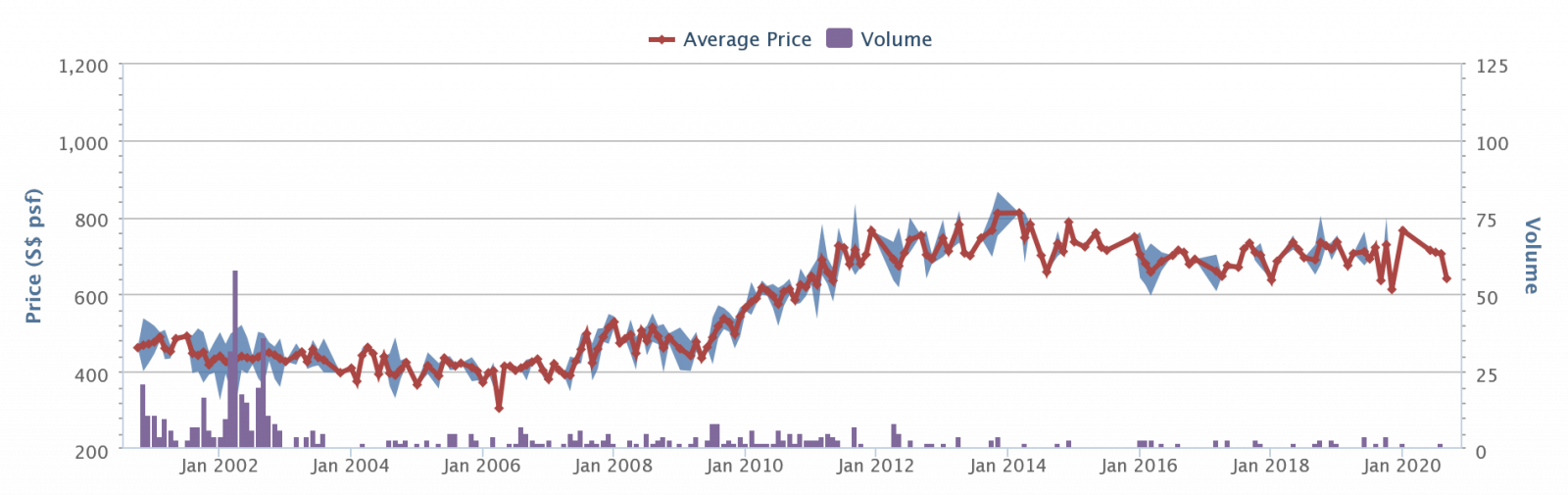

How has The Tampines Trilliant fared against nearby private condos?

Unfortunately, there’s no private condo within a one-kilometre radius of The Tampines Trilliant to offer a comparison. But there is a former EC, Pinevale, which is now fully privatised.

(Pinevale was completed in 1999)

This is how Pinevale has performed between 2012 to the present:

In 2012, Pinevale averaged $727 psf. This has since increased to $728 psf. This is an increase of around 0.13 per cent.

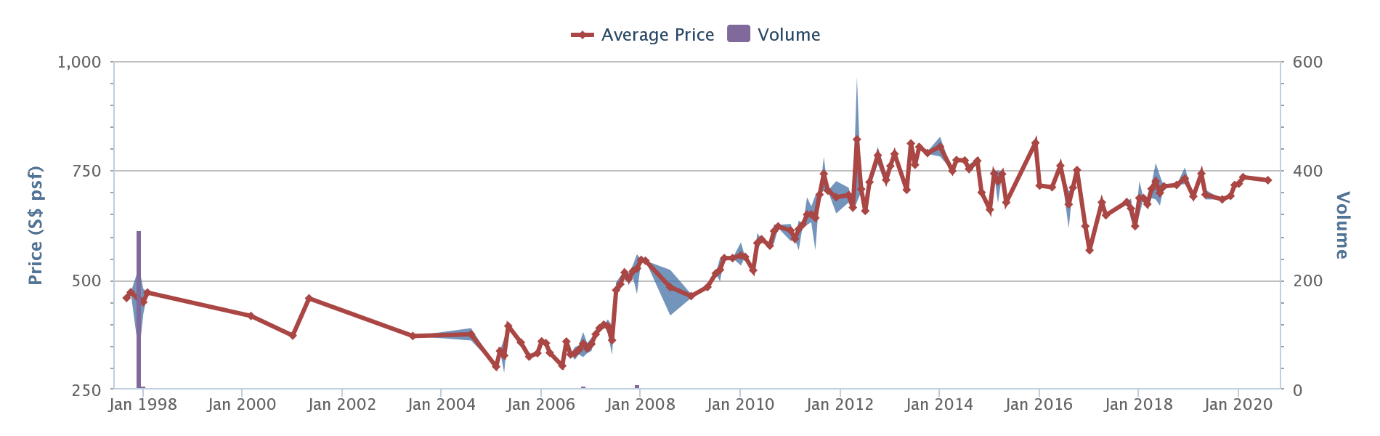

How has The Tampines Trilliant fared against private condos in the same district (18)?

Over the past eight years, private condos in district 18 have appreciated from $912 psf to $1,295 psf. This is an increase of about 42 per cent, or an annualised return of about 4.48 per cent.

This is a gap of about 8.5 percentage points in gains, between The Tampines Trilliant and private condos in the same district.

2. The Rainforest

In September 2012, prices at The Rainforest averaged $757 psf. As of September 2020, prices average $962 psf. This is an increase of 27 per cent, or an annualised gain of about three per cent.

Property Investment InsightsIs An Executive Condo Still Worth It: An Analysis of 53 ECs

by Sean GohTo date, there have been 43 profitable transactions recorded, the following being the top five for 2020:

| Date | Size (Sq. Ft.) | Purchase Price (PSF) | Sale Price (PSF) | Profit | Annualised Return |

| 24 Jul 2020 | 1,249 | $784 | $1,081 | $371,000 | 4.3% |

| 30 Mar 2020 | 1,152 | $787 | $1,051 | $304,000 | 3.7% |

| 27 Jul 2020 | 1,238 | $756 | $1,000 | $302,000 | 3.4% |

| 27 Jul 2020 | 1,152 | $723 | $981 | $297,000 | 3.8% |

| 13 Apr 2020 | 1,292 | $715 | $945 | $292,000 | 3.5% |

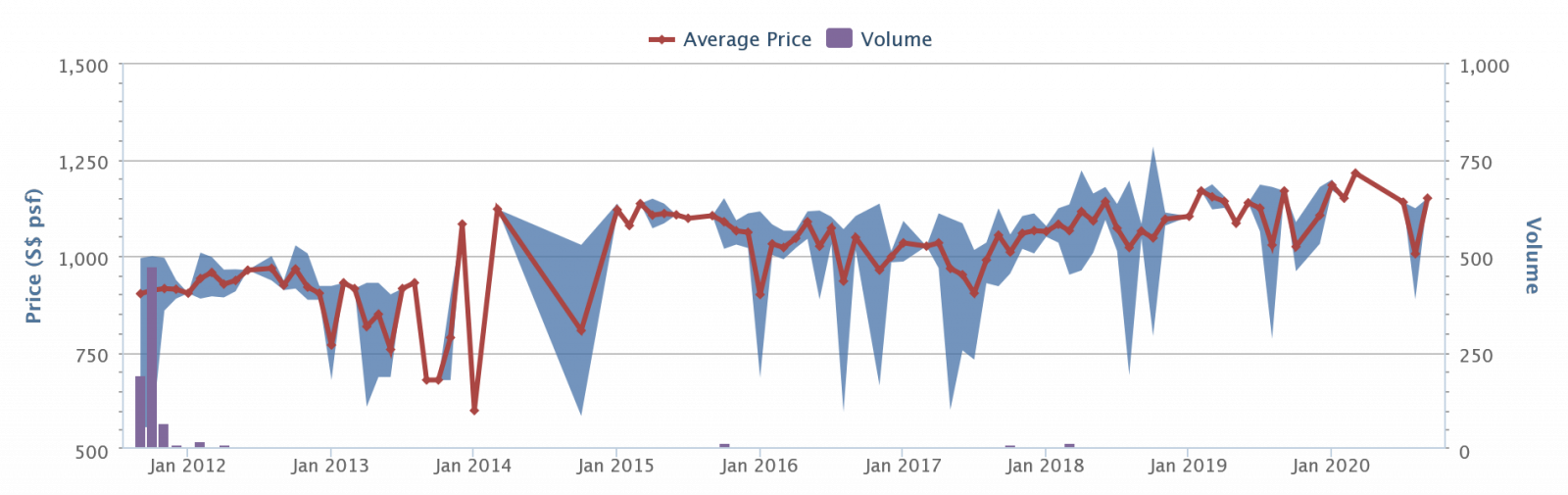

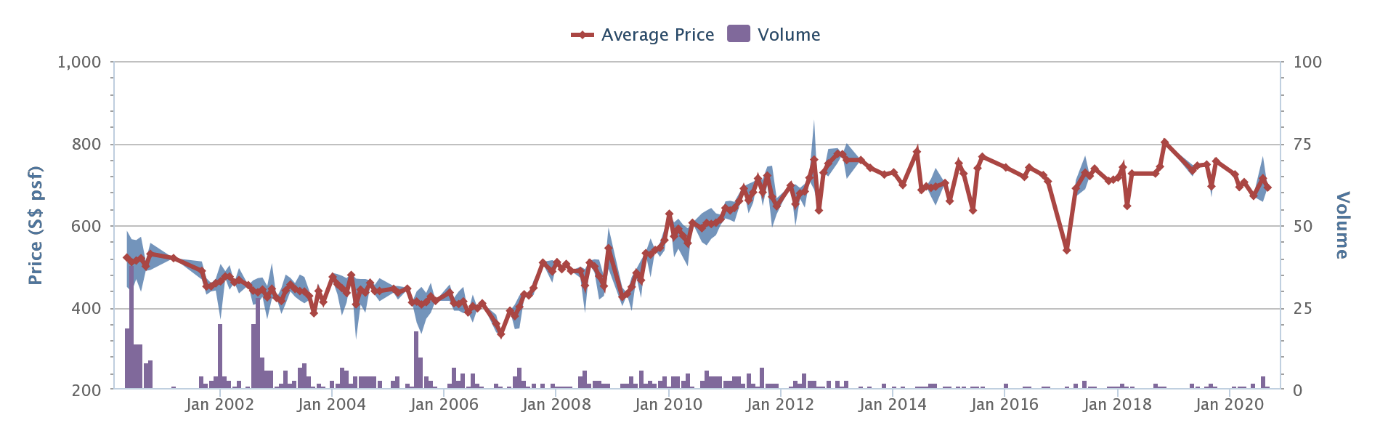

How has The Rainforest fared against nearby private condos?

The closest private condo to The Rainforest is Mi Casa:

In 2012, the average price at Mi Casa was $963 psf. At present, it has fallen to $918 psf. This is a decrease of 4.67 per cent, or an annualised loss of about 0.6 per cent.

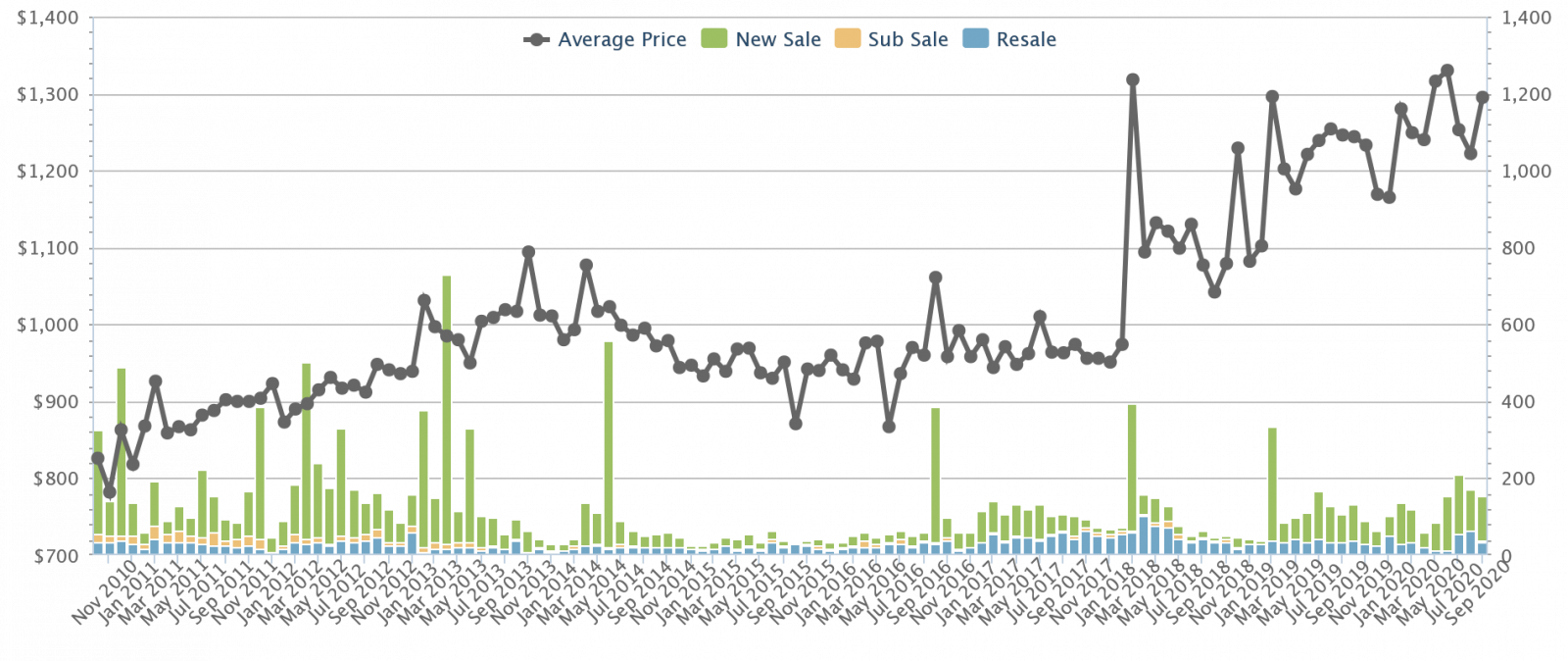

How has The Rainforest fared against private condos in the same district (23)?

In 2012, private condo prices in District 23 averaged $992 psf. At present, prices average $1,046 psf. This is an increase of about 5.4 per cent, or an annualised gain of about 0.66 per cent.

The Rainforest has outperformed its private counterparts in District 23, by 21.6 percentage points.

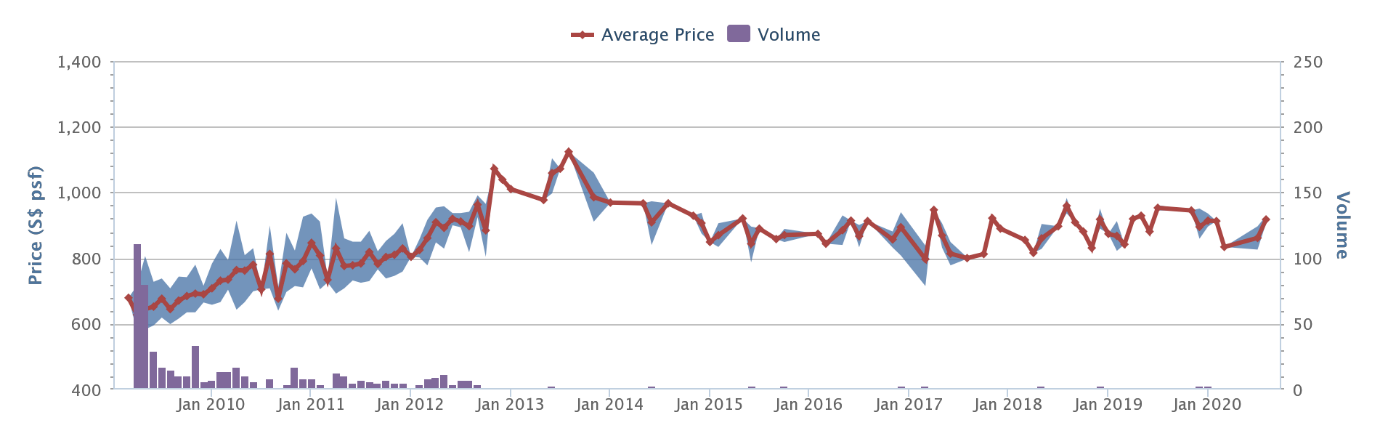

3. Twin Waterfalls

In September 2012, prices at Twin Waterfalls averaged $720 psf. As of September 2020, prices average $975 psf. This is an increase of 35 per cent, or an annualised gain of about 3.8 per cent.

To date, there have been 43 profitable transactions recorded, the following being the top five for 2020:

| Date | Size (Sq. Ft.) | Purchase Price (PSF) | Sale Price (PSF) | Profit | Annualised Return |

| 1 Sep 2020 | 1,238 | $756 | $1,091 | $414,150 | 4.5% |

| 26 Aug 2020 | 1,238 | $749 | $1,065 | $390,650 | 4.3% |

| 2 Sep 2020 | 1,302 | $620 | $906 | $372,500 | 4.6% |

| 16 Jun 2020 | 1,238 | $746 | $1,024 | $344,900 | 4.1% |

| 7 Aug 2020 | 1,238 | $734 | $1,010 | $340,960 | 4.1% |

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How Do I Choose The Right BTO At Bidadari?

Hi Stacked Team!

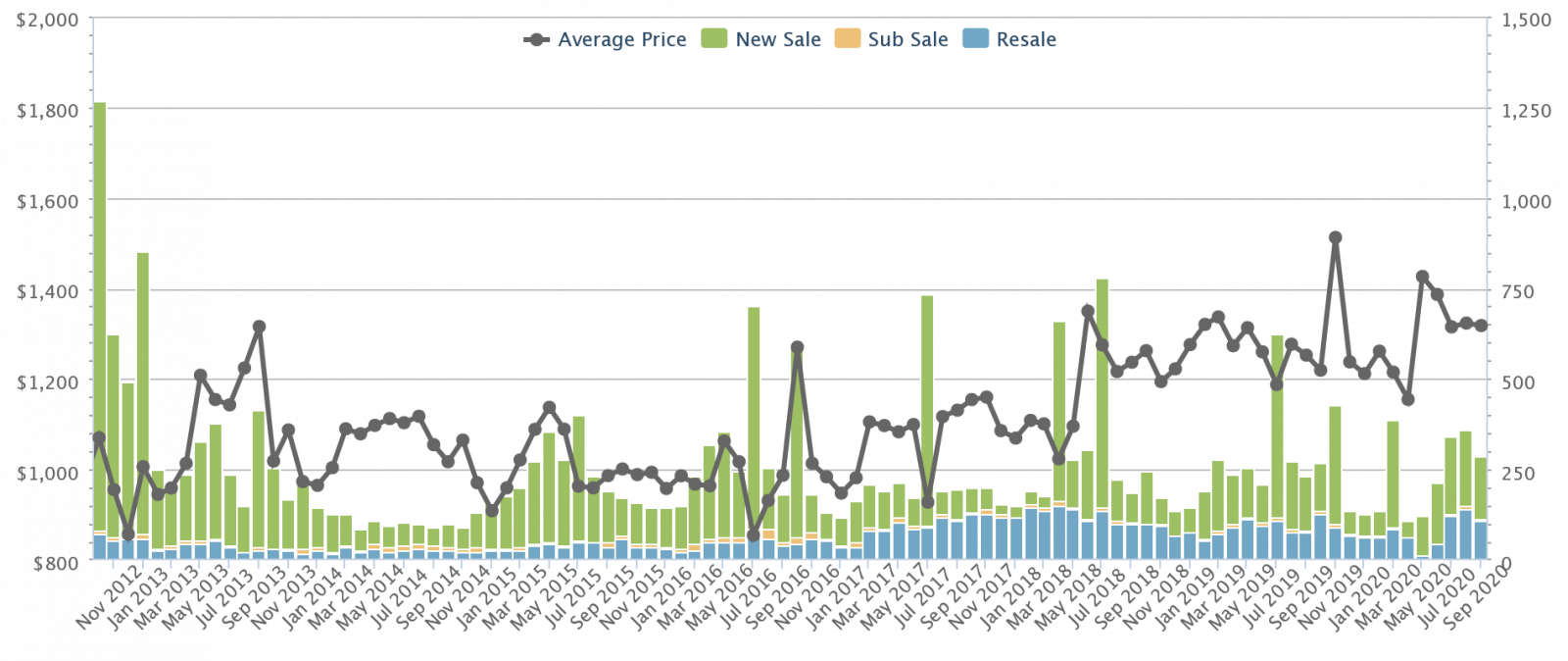

How has Twin Waterfalls fared against nearby private condos?

The closest development for comparison is A Treasure Trove:

In 2012, prices at A Treasure Trove averaged $936 psf. At present, they average $1,075 psf. This is an increase of roughly 14.85 per cent, or an annualised gain of 1.75 per cent.

How has Twin Waterfalls fared against private condos in the same district (19)?

In 2012, average private condo prices in District 19 were at $1,070 psf. At present, prices have increased to $1,318 psf. This is an increase of roughly 23.1 per cent, or an annualised gain of about 2.64 per cent.

Twin Waterfalls has outperformed condos in the same district by about 11.9 percentage points.

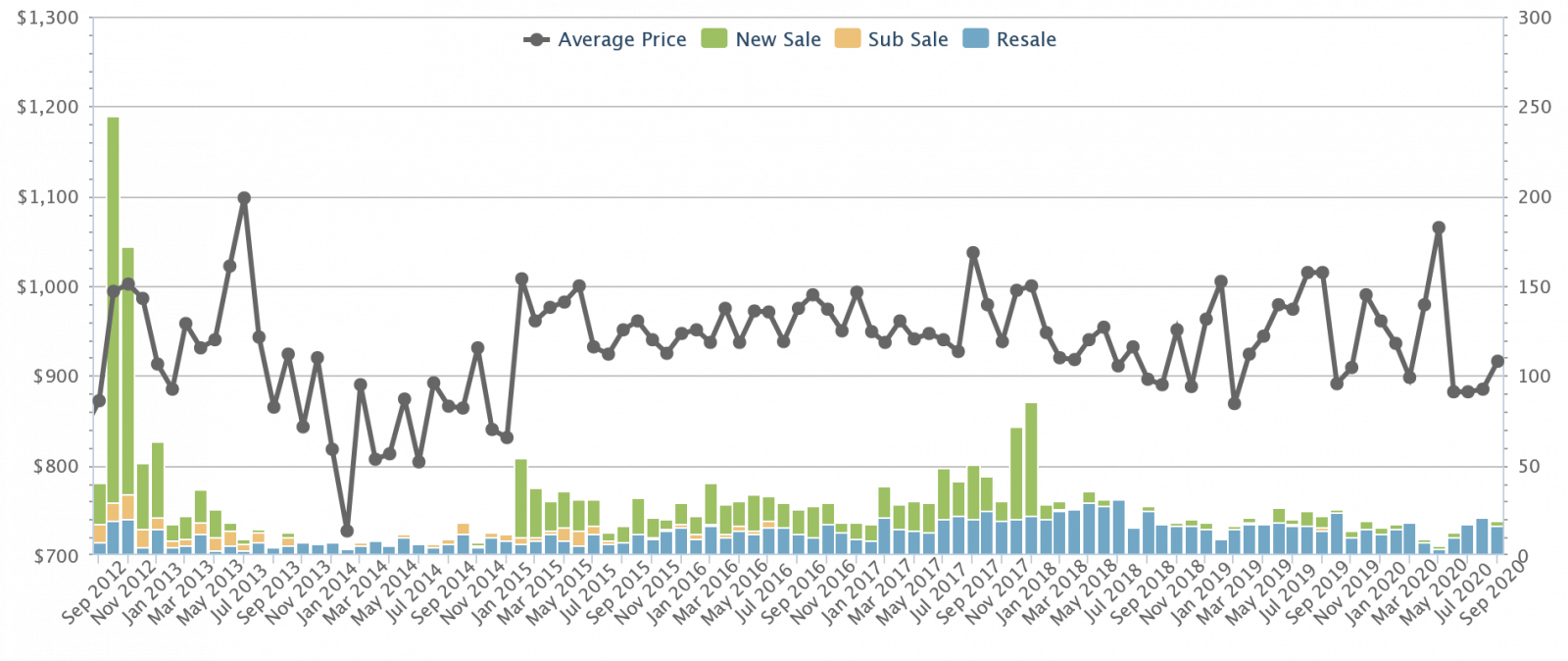

4. 1 Canberra

Prices at 1 Canberra averaged $707 psf in 2012. This has since risen to $893 psf, a percentage gain of 26.3 per cent. This is an annualised return of 2.9 per cent.

There have been 17 profitable transactions for 1 Canberra, of which the following are the top five in 2020:

| Date | Size (Sq. Ft.) | Purchase Price (PSF) | Sale Price (PSF) | Profit | Annualised Return |

| 12 Feb 2020 | 1,012 | $707 | $939 | $234,650 | 3.9% |

| 23 Sep 2020 | 1,249 | $706 | $905 | $248,650 | 3.3% |

| 28 Sep 2020 | 1,539 | $567 | $715 | $227,200 | 3.3% |

| 28 Sep 2020 | 1,044 | $745 | $939 | $202,650 | 3.2% |

| 25 Sep 2020 | 947 | $738 | $948 | $198,800 | 3.2% |

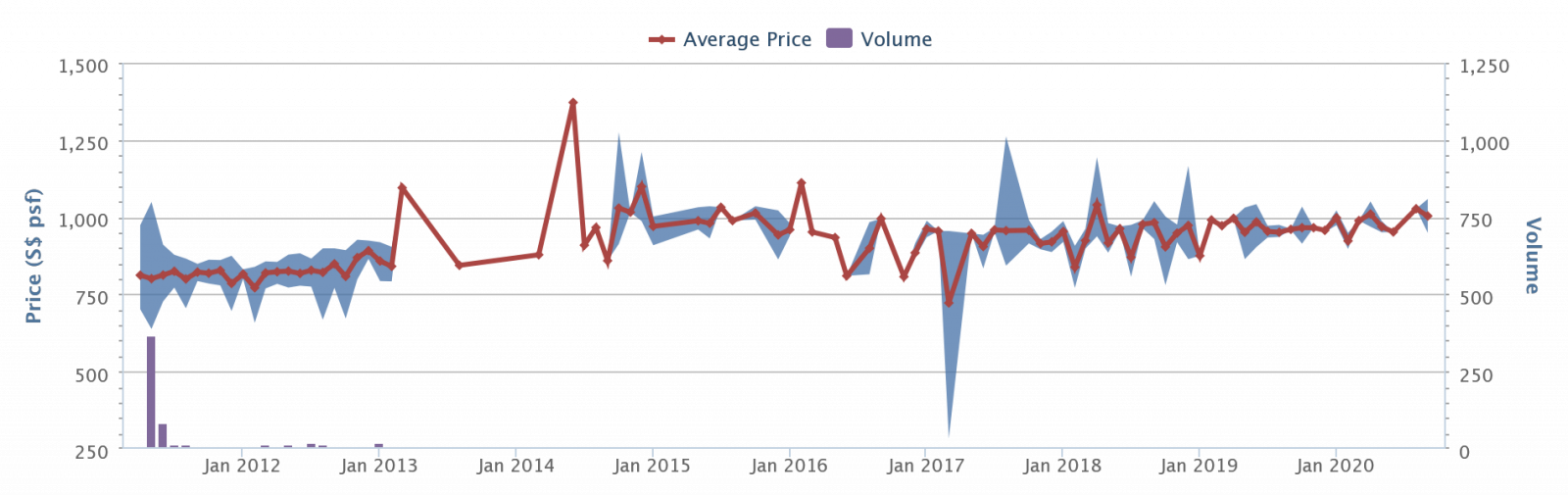

How has 1 Canberra fared against nearby private condos?

There are is a cluster of private condos close to 1 Canberra, which are Eight Courtyards, Yishun Emerald, and Yishun Sapphire.

Eight Courtyards

As of October 2012, prices at Eight Courtyards averaged $808 psf. They have since appreciated to $988 psf. This is an increase of 22.2 per cent, or an annualised gain of about 2.55 per cent.

Yishun Emerald

As of October 2012, prices at Yishun Emerald averaged $703 psf. They have since decreased to $695 psf. This is a decrease of 1.14 per cent, or an annualised loss of about 0.14 per cent.

Yishun Sapphire

As of September 2012, prices at Yishun Sapphire averaged $636 psf. They have since appreciated to $692 psf. This is an increase of 8.8 per cent, or an annualised gain of about one per cent.

How has 1 Canberra fared against private condos in the same district (27)?

Average condo prices in District 27 were at $872 psf in 2012. This has now risen to $916 psf. This is a percentage gain of around five per cent, or an annualised return of about 0.62 per cent.

1 Canberra has seen gains that are 21.3 percentage points higher than private condos in District 27.

Are these Executive Condominiums worth buying, instead of getting a private condo?

If we look at the eight-year period, between the launch of these Executive Condominiums and their privatisation, we can see some of them have shown remarkable gains.

Had you bought 1 Canberra instead of a private condo between 2012 to the present, for example, you would actually have seen better gains than most of the private condos in District 27.

It just goes to show that in some situations, an EC can beat out a private condo in terms of gains; often for no other reason than their much lower price point.

Besides being able to move in right away, note the following advantages to a resale EC:

- As with new ECs, there’s no upfront Additional Buyers Stamp Duty (ABSD) when upgrading from a flat to an EC.

With private condos, you would need to pay the ABSD first; you can then apply for ABSD remission later. That’s if you meet the eligibility conditions, and you sell your flat within six months of the purchase. It’s much more troublesome.

- The five-year MOP applies to the first batch of EC buyers, not to buyers of resale ECs.

- It’s possible to keep your flat, while also owning a resale EC (provided you have the funds of course). You cannot, however, do this if you buy a new EC – as long as an EC is not past its MOP, you must dispose of your flat within six months of buying it.

(You still need to meet the MOP on your flat as well, to own both properties).

- Resale ECs are already halfway to full-privatisation. By the time the EC crosses its 10th year, you’re free of restrictive HDB rules; you can even sell your EC unit to foreigners and companies.

These factors make resale ECs especially attractive to certain buyers today.

As with new ECs, resale ECs will remain attractive to “sandwiched” Singaporeans due to their lower price point. But the key draw will be the convenience they provide: an HDB upgrader can buy and move in right away, without having to bother about ABSD.

Given that it’s only five more years to full privatisation, a resale EC’s temporary status as an HDB property is also not a big drawback.

The only problem is one that has plagued most Executive Condominiums since their inception: most of them are painfully far from the nearest MRT station. But this is an issue for a future article: so do follow us on Stacked, for deeper reviews of specific properties and their amenities.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How have the prices of the 2015 Executive Condominiums changed since they were completed?

What is the performance of resale ECs compared to private condos in the same districts?

Are resale ECs a good investment compared to private condos?

What are the advantages of buying a resale EC instead of a private condo?

What are the main drawbacks of ECs, especially regarding location?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

2 Comments

does this mean that when upgrading from a HDB to a resale EC, it is possible to keep your HDB and buy the resale EC without paying ABSD? as long as i have meet the MOP requirement for my HDB?