Why We Bought A 3-Bedder Condo At Penrose: A Buyer’s Case Study

Grady, an engineer turned real estate agent since 2014, brings a wealth of experience and a commitment to excellence. From understanding market trends to offering tailored solutions, he navigates the property landscape with expertise. Driven by data and a heart to serve, Grady prioritizes transparency and ethical choices for his clients. He empowers his clients to make confident decisions in their property journey by equipping them with comprehensive knowledge, no matter the scale. For more than a decade, he has overseen transactions totalling over $170 million in property sales. Outside work, Grady enjoys tennis, hiking, and quiet moments with a good book.

Project Case Study: Penrose

Client Details

- Young couple in their 30s, looking for their first matrimonial home.

Buyer’s Brief

- Looking for somewhere central.

- Looking to buy within the next 1-2 years. Open to both HDB and Private. Did not consider BTO or New Launches due to the waiting time. Looking to purchase something with good capital retention and capital appreciation if possible.

Challenges they faced

- Don’t know much about the property market, looking to purchase a first home but not sure where to start and what options to consider.

First-time home buyers tend to have it rough right now, as 2024 is far from the most affordable period in the property market. Besides the high cost of financing, it is also – somewhat ironically – a time when options can seem overwhelming. We’re coming off the tail end of a supply crunch, so there’s quite a resurgence in the number of available projects. Here’s how we guided a pair of first-time home buyers, C and W, on their property purchase:

Understanding the buyers’ needs and preferences

It started with a phone call on the 1st week of February this year. As per usual, our priority with C was to determine what they needed. In some cases, homebuyers can get mixed up with their priorities of what they want from a home (between an investment or their own stay), and it is our job to tease out which is more important. In this case, C and W are a young couple in their 30s, looking for their first matrimonial home.

The former is in education and the latter in healthcare, and neither was familiar with the property market. We did ascertain a time period of one to two years to buy; and whilst they were open to both HDB and private properties, we established they didn’t want to wait for the construction time (so no BTO flats or new launches that are under construction).

Also, because C stays in the west and W stays in the east, we would be looking for a compromise by going somewhere central.

Initial meet-up

We met up with the couple a while later that month, to run through some of the basic concerns. For new home buyers, who are unfamiliar with the market, we prefer to run through the fundamentals before shortlisting any properties.

We showed them recent transactions from the URA website to orient them with prices today, and went over issues of supply and demand, the Property Price Index (PPI), and our projections based on the pipeline of upcoming projects.

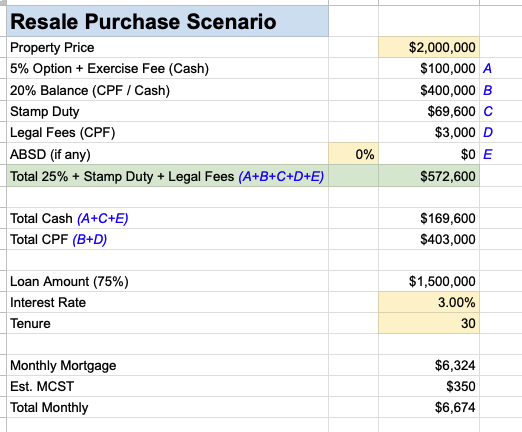

As first-time buyers, C and W were uncertain about the costs, so we briefed them on the numbers involved. We worked through the financial calculations based on two scenarios: a typical joint purchase, versus purchasing the property under just one of their names.

We also gave them a relevant contact to check on their loan eligibility, based on either scenario. This initial consultation took around two hours, after which they left to mull over the decision.

The second meet-up, and looking into viable areas

We got on a call again after a week, and at this point, C and W expressed interest in the private market. They were open to the idea of two or three-bedders in the Rest of Central Region (RCR), preferably one within walking distance to the MRT.

The initial budget was $1.7 million to $1.8 million. As mentioned above, construction time was out of the question, so we would be looking at either resale or sub sale units. The main districts of interest were:

- District 12 (Boon Keng)

- District 14 (Aljunied, Paya Lebar)

- District 20 (Bishan)

We then shortlisted some two and three-bedders in these areas. In the meantime, we showed how two and three-bedders have performed over the past two years, to get a sense of pricing and demand:

In the past five years, two-bedders have appreciated by over 36 per cent on average, whereas three-bedders are up by over 47.7 per cent. This shows the significant shift in preference toward larger units, in the aftermath of Covid. This is likely to show better resale performance or capital retention in a downturn, so the decision was made to look for three-bedder layouts.

Examining options in each district

Our next stage, which started in March, was to start shortlisting possible options in Districts 12, 14, and 20. Now we knew we were looking for three-bedders that are resale or sub sale units.

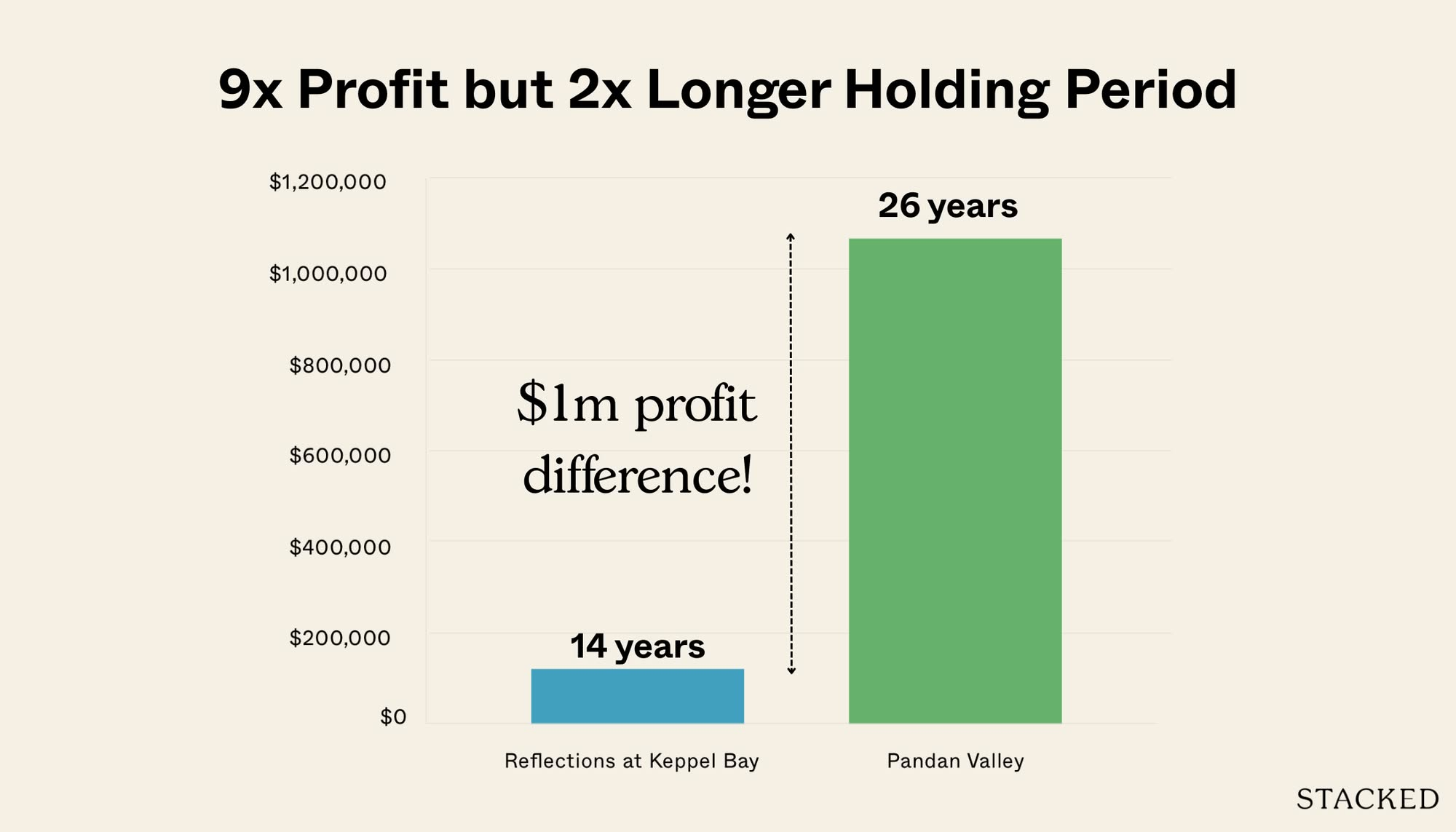

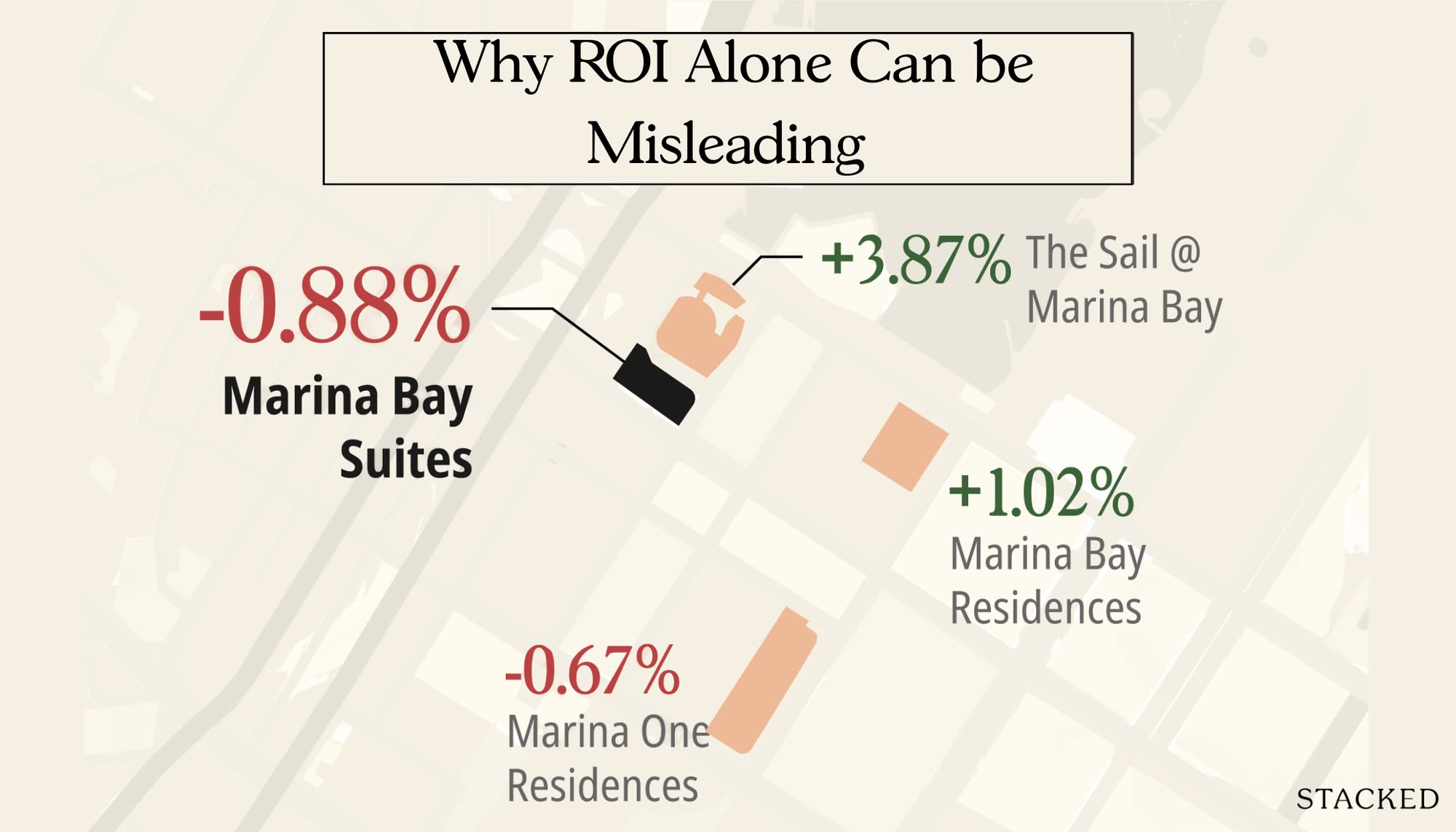

Our philosophy is to enhance clarity to facilitate well-informed decision-making, rather than railroad buyers toward certain properties. One of our concerns is that the home you buy shows resilience even in challenging market conditions, and superior performance in favourable ones.

We use five distinct “price movement” periods to evaluate each project. The performance of the project during these periods (as seen on the PPI) helps us to assess whether they underperform or align with market norms in those periods:

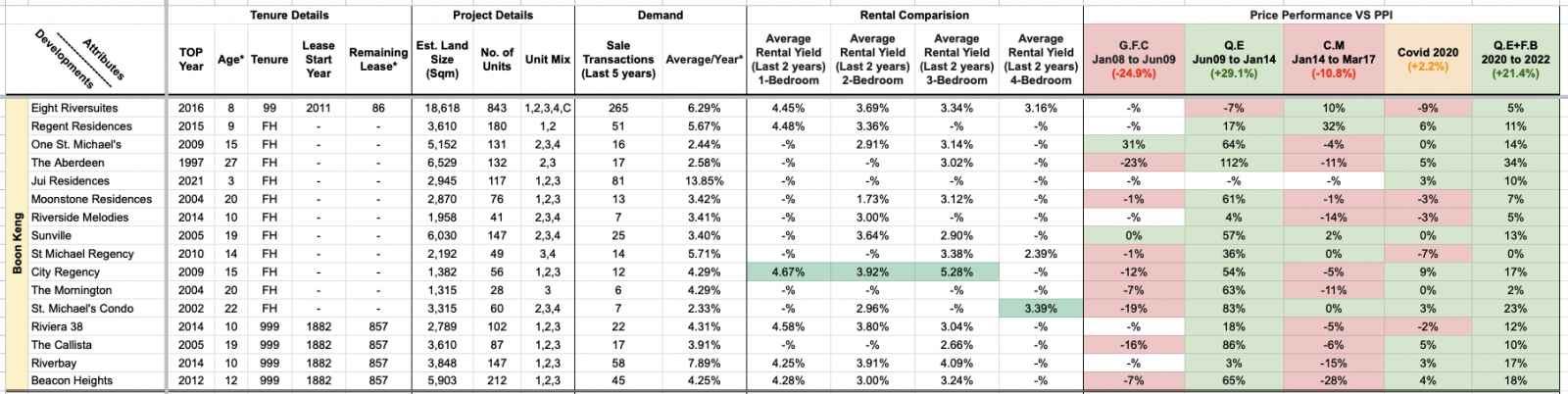

First off, District 12 – Boon Keng:

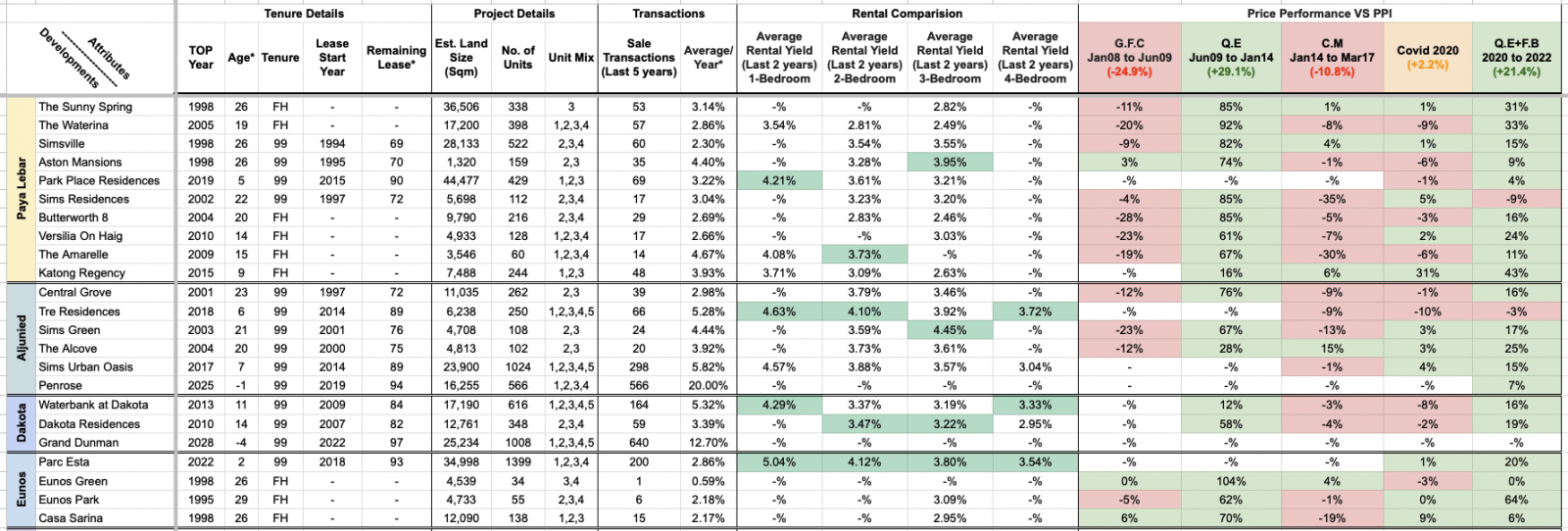

District 14 – Aljunied/Dakota/Eunos/Paya Lebar

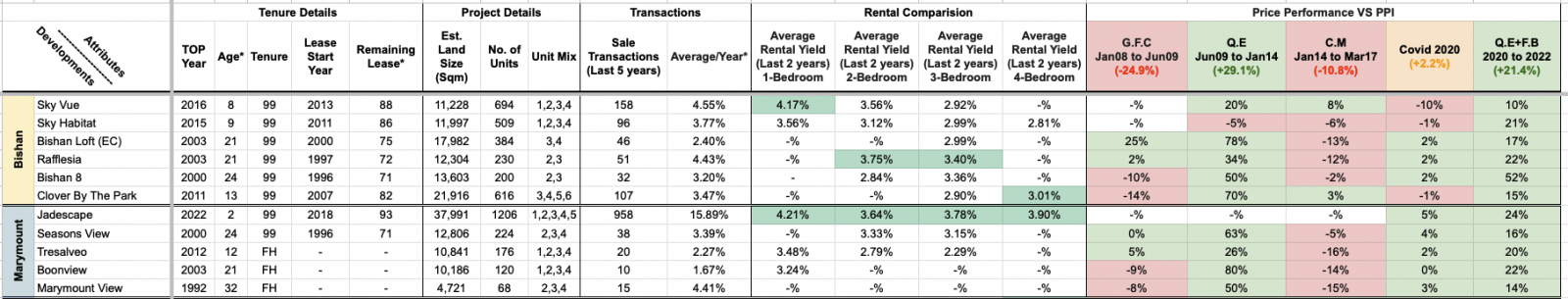

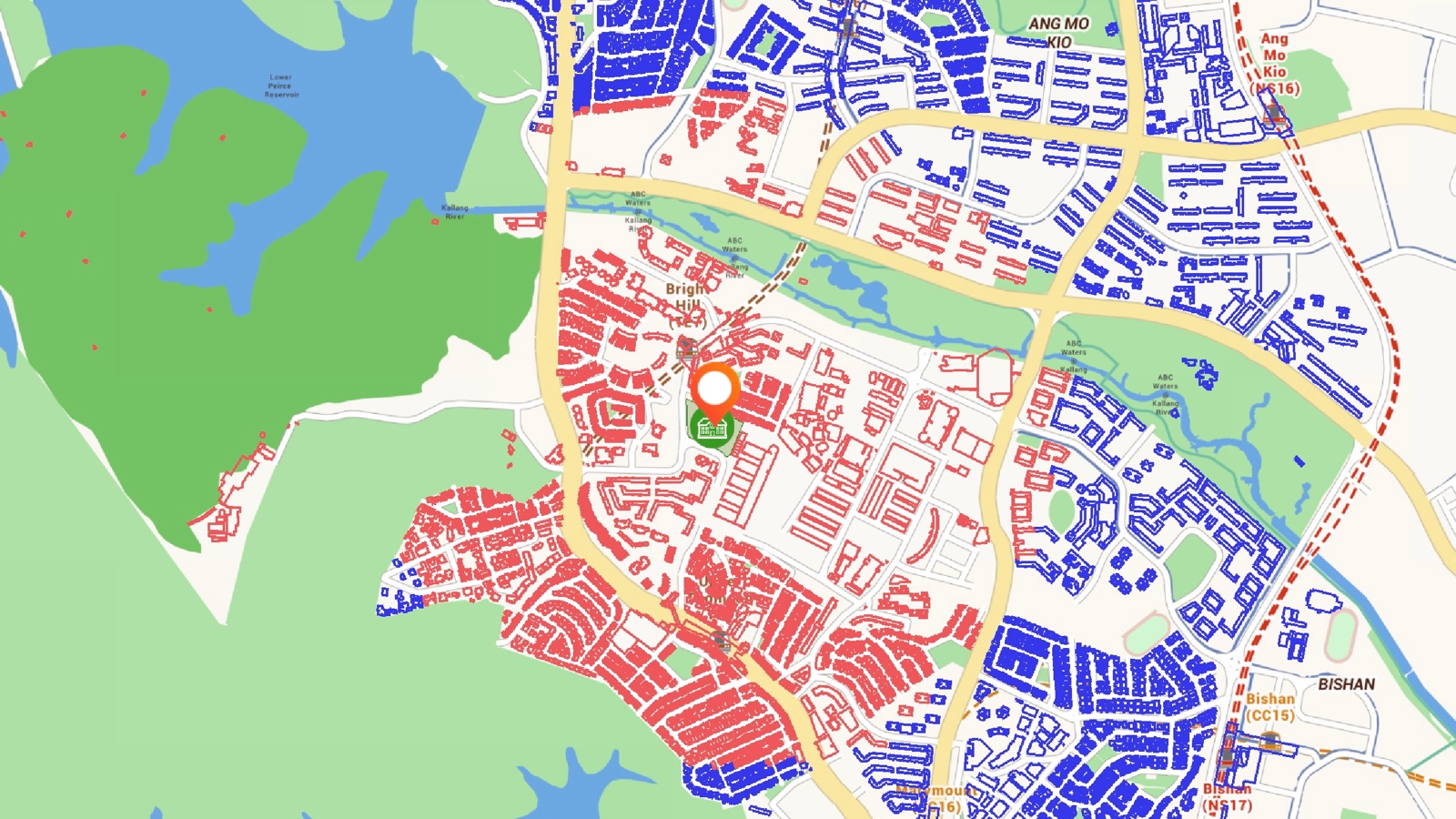

District 20 – Bishan

A quick explanation:

GFC (Global Financial Crisis)

Q.E (Quantitative Easing)

C.M (Cooling Measures)

F.B (Fortitude Budget)

Red signifies a declining market, Green indicates an upward trend, and Covid represents uncertainty.

This is a snapshot of how the project has performed under the given conditions. For a more precise assessment, we’ll delve deeper into the performance of each layout and unit within the development, by further studying the profitability (or unprofitability) of each stack.

Conclusions from looking at each district

District 20 was removed from the options at this stage, as the three-bedders exceeded $2 million on average for newer developments. There was only one viable option (Bishan 8) that was within budget, but this was a 24-year-old leasehold property, and lease decay was a potential factor.

This leaves us with districts 12 and 14.

District 12 had a few projects that were both within range of the MRT station and also within budget. The only viable option we identified here was Eight Riversuites, which we put on the shortlist.

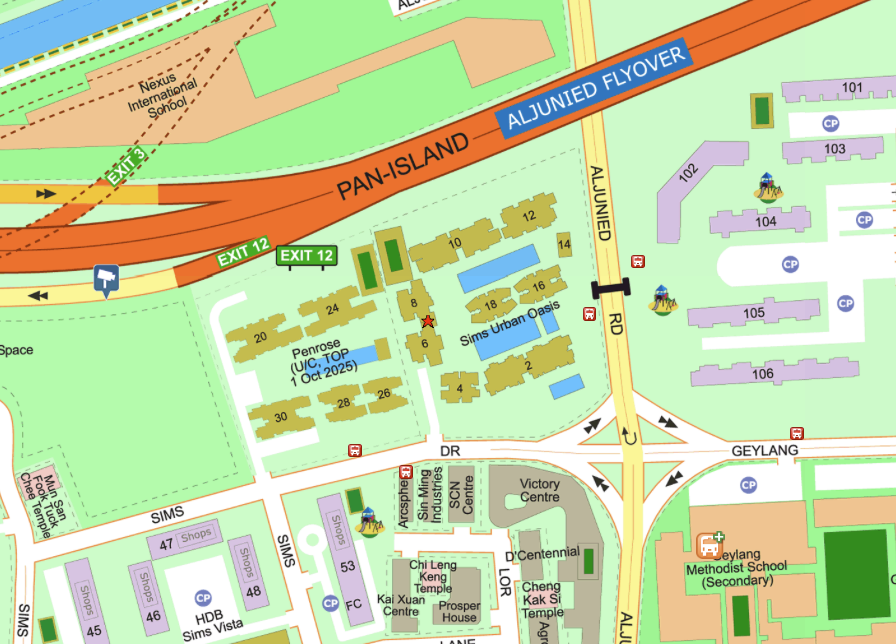

District 14 showed the widest range of options, even though many of the developments were older. We tried to skirt around lease decay issues by looking at freehold condos here, but few to no three-bedders were available in this segment. As such, we kept the options to condos 15 years old or younger; and this provided possible three-bedder options in The Sunny Spring, Tre Residences, Sims Urban Oasis, and Penrose; these were all within the $1.8 million range.

A final addition to the list was Central Grove; although it’s older than we’d like (23 years old), it is right next to Aljunied MRT, so it merits some further consideration.

Viewings of shortlisted condos begin

More from Stacked

Are Integrated Developments In Singapore Worth the Premium? We Analysed 17 Projects To Find Out

In this Stacked Pro breakdown:

We started viewings as early as April 2024.

Central Grove was the first up. Its three-bedder unit was a sizeable 1,217 sq. ft., with an asking price of $1.69 million. C and W liked the spaciousness; but the age, facilities, and communal areas didn’t seem very well-maintained. Another concern was the proximity to the MRT tracks, and C had a preference for a quieter facing. Ultimately though, the age of the development, and the overall package of the project meant that this wasn’t the right choice.

This also gave us a new detail to consider: we then moved down some shortlisted units that had noisier facings, such as near roads or MRT tracks. This also deprioritised Eight Riversuites, as this development is between Serangoon Road and Bendemeer Road – both major thoroughfares.

Tre Residences was up next. It is quite close to Central Grove, and was completed only in 2018. Like most newer condos, however, the units are a lot smaller. The three-bedder here was only 861 sq. ft., a glaring difference from Central Grove; and the couple felt this was too small.

Sunny Spring was also viewed and declined, due to largely similar issues with Central Grove (age, facilities, and maintenance of common areas).

This left us down to two points of comparison: Penrose and Sims Urban Oasis.

The challenge here is that both projects are right beside the expressway (PIE), so our options would have to be inward-facing units to avoid the noise. Price-wise, we found sub-sale three-bedders at Penrose, clocking in at $2,000 to $2,200 psf, while Sims Urban Oasis was in the range of $1,9XX psf.

Given the small price gap, our recommendation was to look at Penrose instead – it’s much newer, and is less densely packed.

Sims Urban Oasis has a land size of 23,900 sqm. and 1,024 units. That’s about 23.34 sqm. of communal space per unit.

Penrose has a land size of 16,255 sqm, but only 566 units; or about 28.27 sqm. of communal space per unit.

At this point, our other options besides these two were limited; but the budget would have to be pushed to $1.9 million or $2 million. After another round of number-crunching, we had the green light to do so.

Further viewings and considerations

Penrose was still under construction, so viewings weren’t possible beyond the usual show flat/sales gallery.

For Sims Urban Oasis, we initially looked at a 1,033 sq. ft. three-bedder with an asking price of $1.99 million. We decided to keep our options open: if we had to pick between facing the expressway or a pool view, for example, it would come down to pricing. If the road-facing unit costs a lot less, it could still be a good buy as there are steps we can take (e.g., double-glazing windows to block some of the noise).

The unit in question, along with another one, faced the expressway. We measured the noise level for the units at about 70 decibels at times (the recommended level by the World Health Organisation is 55 or below). As such, we tried to find units facing Sims Drive instead (a less busy road) or an inner pool facing.

A discussion on the issue of road facings

We got on a call with C and W, and went over the issue of road facings again. One of the concerns brought up besides noise would be the impact on future resale value.

In light of this concern, we decided to pull up the transaction records of Sims Urban Oasis, to see how badly the expressway facing would impact sales (we couldn’t do this for Penrose though, as it’s a new launch – this is one of the advantages of a resale unit).

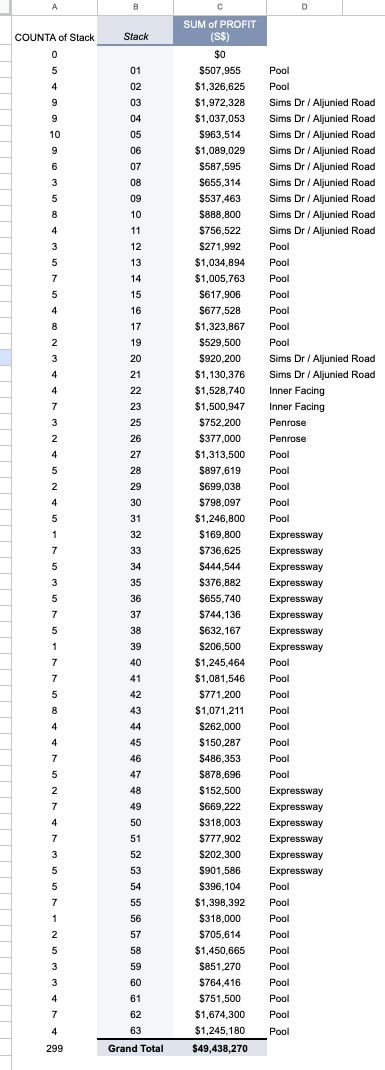

We reviewed the past six years of transaction data, to identify the impact of the different facings (note that we’d have to do this eventually anyway, as it’s part of identifying which stacks are better performers):

From the above results, we’ve answered both the questions on resale gains based on facing (the pool-facing beat the expressway facing!) and determined some of the better stacks. Our choices came down to stacks 29, 30, and 33.

Unfortunately, 33 was out, as there were no available units – a pity as it was our first preference. Our second preference was 30, of which there were two units listed for sale. Our third preference, 29, had seven available units. This is typically the issue when you are looking for resale condos as it is down to what is available for sale at that point in time – and you’ll never know what supply may even come up (as you’ll soon see further below).

In any case, the asking prices for the two units at Stack 30 were much higher (over $2.1 million) compared to Stack 29 (below $2 million), which settled the matter – it would have to be 29.

A last minute stroke of luck

We noticed that, for stack 29, the lower floor unit (which was also the cheapest) was quite close to the main entrance – this means being near the drop-off point and the childcare, which brings up noise concerns.

As such, we narrowed the options down to the middle or higher floors of stack 29. We picked out the lowest-priced, best-value unit at this level, and were ready to proceed. Just before the deposit for a unit was made though, we did another last-minute search. This was to see if new units had become available: a good practice since you can suddenly find good deals.

This time it paid off: we found a mid-floor unit at stack 33, which was our first preference. We did the viewing and negotiations fast, and we actually managed to get the unit at a lower price psf than the unit at stack 29.

The journey of guiding C and W through their first property purchase was a meticulous and rewarding process. By understanding their needs, evaluating options, and considering both financial and personal preferences, we were able to navigate the complexities of the current property market.

Despite the challenges of a high-cost market and the overwhelming number of options, we prioritised informed decision-making and flexibility. Our approach ensured that C and W were not just finding a home, but making a sound investment that aligned with their long-term goals.

In the end, their perseverance and willingness to explore various options paid off. The last-minute discovery of a preferred unit in stack 33 at Penrose, at a favourable price, was a testament to the importance of thoroughness and timing in the property market.

If you’d like to get in touch for a more in-depth consultation such as the one above, you can do so here.

Grady

Grady, an engineer turned real estate agent since 2014, brings a wealth of experience and a commitment to excellence. From understanding market trends to offering tailored solutions, he navigates the property landscape with expertise. Driven by data and a heart to serve, Grady prioritizes transparency and ethical choices for his clients. He empowers his clients to make confident decisions in their property journey by equipping them with comprehensive knowledge, no matter the scale. For more than a decade, he has overseen transactions totalling over $170 million in property sales. Outside work, Grady enjoys tennis, hiking, and quiet moments with a good book.Read next from Investor Case Studies

Investor Case Studies Why We Chose A $1.23 Million 2-Bedroom Unit At Parc Vista Over An HDB: A Buyer’s Case Study

Investor Case Studies How We Made $270k From A $960k Condo Bought During COVID: A Buyer’s Case Study

Editor's Pick Why I Bought A 2-Bedder Investment Property At Leedon Green In District 10: A Buyer’s Case Study

Editor's Pick Why We Bought A $1.9xm Unit At The Continuum: A Buyer’s Case Study With Stacked

Latest Posts

Property Advice How Much Is Your Home Really Worth? How Property Valuations Work in Singapore

Property Investment Insights Singapore Property Data Is Transparent: But Here’s Why It Can Still Mislead You

Pro Why Marina Bay Suites May Look Like a Poor Performer—But Its 4-Bedroom Units Tell a Different Story

On The Market 5 Cheapest Convenient 1-Bedders Near Integrated Developments From $800k

Property Advice Why I Had Second Thoughts After Buying My Dream Home In Singapore

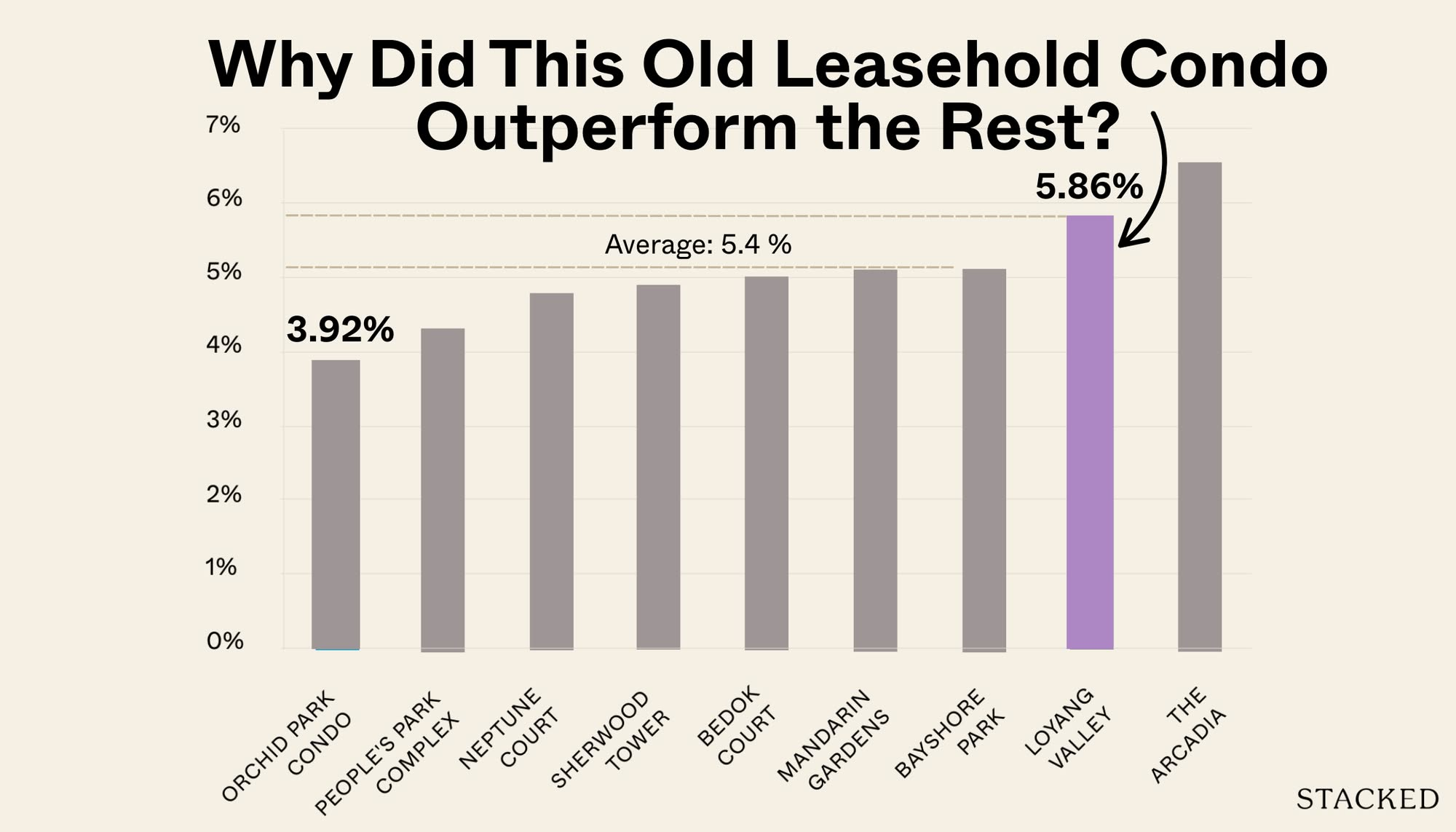

Pro Why This 40-Year-Old Leasehold Condo Beat Newer Developments: A Case Study Of Loyang Valley

Editor's Pick 50 New Launch Condos With Balance Units Remaining In 2025 (From $1,440 PSF)

Editor's Pick Is Arina East Residences Worth A Look? A Detailed Pricing Review Against District 15 Alternatives

Singapore Property News This West-Side GLS Plot Just Got A $608M Bid And 6 Bidders: Why Lakeside Drive Bucked The Trend

Editor's Pick Touring A Rare Stretch of Original 2-Storey Freehold Terrace Homes At Joo Chiat Place From $3.02m

Singapore Property News The 1KM Primary School Rule In Singapore: Fair Game Or Property Power Play?

Singapore Property News 1,765 Punggol Northshore HDB Flats Reaching MOP: Should You Sell Quickly or Wait?

Editor's Pick Love Without A BTO Flat: The Tough Housing Choices Facing Mixed-Nationality Couples In Singapore

Property Market Commentary I Reviewed HDB’s Showroom For 4 And 5-Room Flats. Here’s What Future Homeowners Should Know

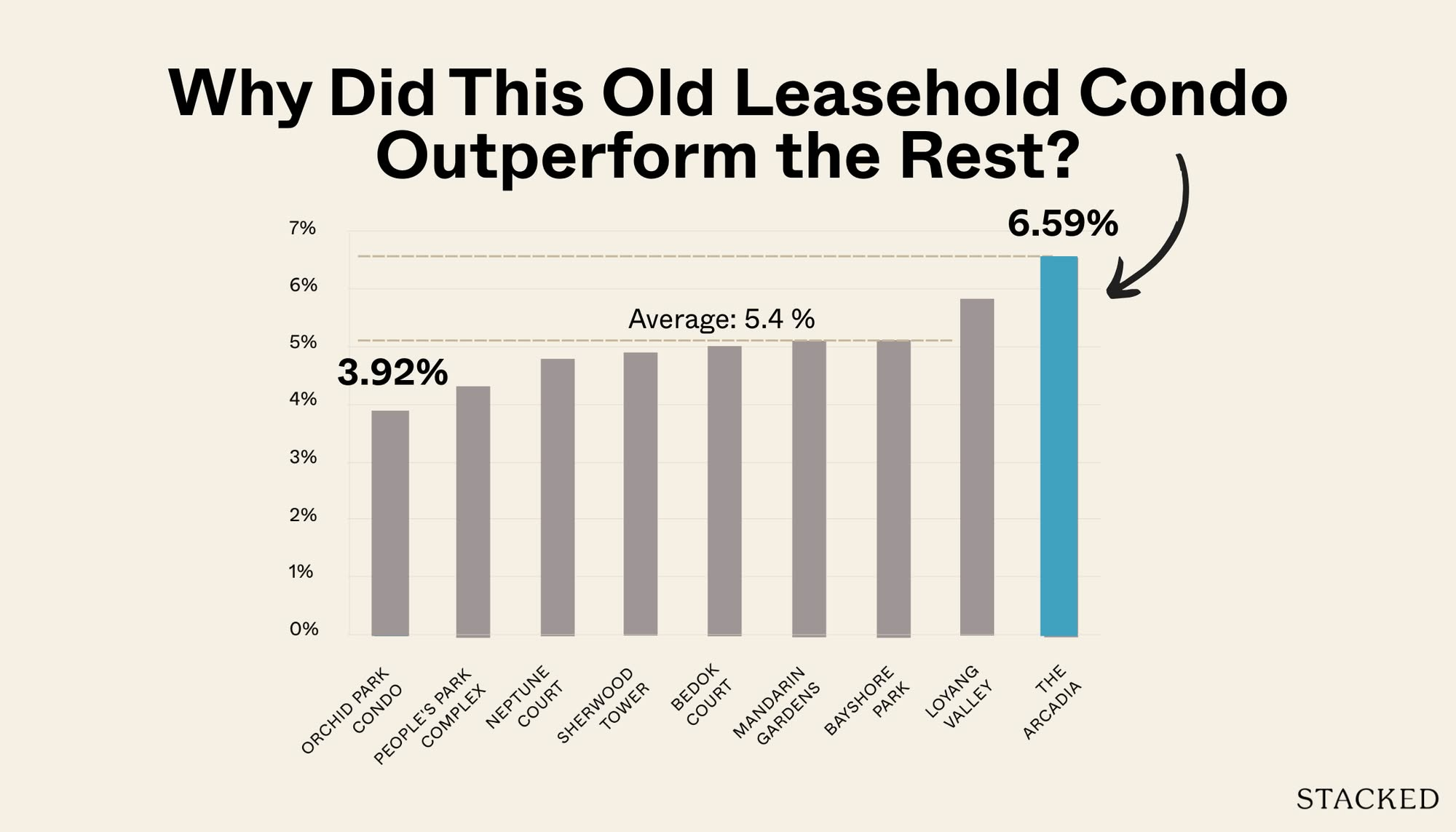

Pro Can 30+ Year-Old Leasehold Condos Still Perform? The Arcadia’s Surprising Case Study

the article header says penrose while the end of the article states that the client purchased stack 33 at Sims Urban Oasis, which is the final condo that they purchased?

Seems like there was confusion over what they purchased.

Hi! Got a couple of questions:

The analysis was for Sims Urban but the author seems to be confusing it with Penrose!

In the end, they bought Sims not Penrose right?

Btw, stack 33 faces expressway not pool based on your data…