Is The Best Time To Sell Your New Launch Condo Before Or After Completion? Here’s What The Data Says

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

There has been considerable interest in determining the optimal time to sell your new launch condo, particularly as the supply increases with more condos from recent launches nearing completion.

The debate is straightforward: Should you sell before the condo is completed? Selling early provides quicker access to profits and frees up your name for other potential deals. Additionally, you may face less competition by selling early, especially if you own a unit in a mega-development.

On the other hand, waiting until the development is completed has its advantages. There may be increased demand from buyers ready to move in, and if the condo exceeds expectations, it could fetch a higher price. However, there’s also the risk that build quality issues might emerge, negatively impacting your sale price.

So, is selling early truly more profitable, and how does the timing of your sale affect your returns? We analysed the numbers from several condo sales to find out:

Projects that we used for comparison

For comparison, we used private, non-landed projects that were launched from 2018 onward. We also checked that there were new to resale, as well as new to sub sale transactions for comparison:

| Project | New Sale to Resale (Vol) | New Sale to Sub Sale (Vol) | Total Volume |

| AMBER 45 | 10 | 1 | 11 |

| AVENUE SOUTH RESIDENCE | 37 | 2 | 39 |

| BUKIT 828 | 1 | 1 | 2 |

| DAINTREE RESIDENCE | 8 | 16 | 24 |

| FOURTH AVENUE RESIDENCES | 2 | 13 | 15 |

| JADESCAPE | 45 | 80 | 125 |

| JUI RESIDENCES | 7 | 2 | 9 |

| KOPAR AT NEWTON | 1 | 15 | 16 |

| MARGARET VILLE | 31 | 4 | 35 |

| MAYFAIR GARDENS | 13 | 14 | 27 |

| MIDWOOD | 6 | 6 | 12 |

| NYON | 3 | 1 | 4 |

| OLLOI | 1 | 1 | 2 |

| PARC ESTA | 56 | 169 | 225 |

| PARK COLONIAL | 52 | 56 | 108 |

| REZI 24 | 1 | 4 | 5 |

| STIRLING RESIDENCES | 107 | 84 | 191 |

| THE ANTARES | 2 | 2 | 4 |

| THE GARDEN RESIDENCES | 69 | 4 | 73 |

| THE JOVELL | 4 | 10 | 14 |

| THE TAPESTRY | 97 | 19 | 116 |

| THE VERANDAH RESIDENCES | 4 | 10 | 14 |

| TREASURE AT TAMPINES | 61 | 275 | 336 |

| TWIN VEW | 43 | 45 | 88 |

| VERDALE | 1 | 1 | 2 |

| WHISTLER GRAND | 48 | 57 | 105 |

| Total Transactions | 674 | 928 | 1602 |

A look at overall returns

| Project | New Sale to Resale | New Sale to Sub Sale | Grand Total | Which is better? | Difference |

| AMBER 45 | +15.1% | +6.1% | +14.3% | Sell After TOP | +9.0% |

| AVENUE SOUTH RESIDENCE | +14.7% | +13.7% | +14.6% | Sell After TOP | +0.9% |

| BUKIT 828 | +8.9% | -4.6% | +2.1% | Sell After TOP | +13.6% |

| DAINTREE RESIDENCE | +21.6% | +22.2% | +22.0% | Sell Before TOP | -0.5% |

| FOURTH AVENUE RESIDENCES | +17.8% | +8.4% | +9.7% | Sell After TOP | +9.4% |

| JADESCAPE | +25.8% | +22.0% | +23.4% | Sell After TOP | +3.8% |

| JUI RESIDENCES | +9.3% | +11.5% | +9.8% | Sell Before TOP | -2.2% |

| KOPAR AT NEWTON | +11.6% | +12.7% | +12.6% | Sell Before TOP | -1.1% |

| MARGARET VILLE | +17.1% | +11.1% | +16.4% | Sell After TOP | +6.0% |

| MAYFAIR GARDENS | +10.3% | +9.8% | +10.0% | Sell After TOP | +0.5% |

| MIDWOOD | +18.4% | +20.9% | +19.7% | Sell Before TOP | -2.5% |

| NYON | +16.3% | +13.2% | +15.5% | Sell After TOP | +3.1% |

| OLLOI | +24.0% | +17.5% | +20.7% | Sell After TOP | +6.5% |

| PARC ESTA | +29.1% | +22.7% | +24.3% | Sell After TOP | +6.4% |

| PARK COLONIAL | +20.8% | +15.7% | +18.1% | Sell After TOP | +5.1% |

| REZI 24 | +4.3% | +7.3% | +6.7% | Sell Before TOP | -2.9% |

| STIRLING RESIDENCES | +24.2% | +20.1% | +22.4% | Sell After TOP | +4.1% |

| THE ANTARES | +19.2% | +12.9% | +16.1% | Sell After TOP | +6.3% |

| THE GARDEN RESIDENCES | +13.5% | +8.2% | +13.2% | Sell After TOP | +5.3% |

| THE JOVELL | +22.7% | +16.9% | +18.5% | Sell After TOP | +5.9% |

| THE TAPESTRY | +16.6% | +11.6% | +15.8% | Sell After TOP | +5.0% |

| THE VERANDAH RESIDENCES | +13.3% | +10.2% | +11.1% | Sell After TOP | +3.1% |

| TREASURE AT TAMPINES | +23.5% | +21.8% | +22.1% | Sell After TOP | +1.7% |

| TWIN VEW | +22.6% | +17.0% | +19.8% | Sell After TOP | +5.6% |

| VERDALE | +12.8% | +13.9% | +13.3% | Sell Before TOP | -1.1% |

| WHISTLER GRAND | +30.7% | +24.6% | +27.4% | Sell After TOP | +6.1% |

| Average | +21.3% | +19.9% | +20.5% | Sell After TOP |

More from Stacked

Queenstown condo: Stirling Residences or Queens Condo?

Queenstown has always been a popular area for Singaporeans to live in. It is a mature estate with lots of…

Overall new to resale transactions came out slightly ahead, which implies it may be better to sell after TOP. However, frankly, the degree of difference is not great. Of the six projects where selling before TOP was better (i.e., new to sub sale), you can see three of them had only one new to resale transaction, whilst Jui Residences only had two such transactions – this makes it hard to draw any accurate conclusions. Midwood is the most notable of the lot, where waiting to sell after TOP made a difference of 2.5 per cent.

However, we need to consider that prices rose significantly in the aftermath of Covid

Due to the housing shortage right after Covid, home prices rose to new highs. Because of this, we would expect that the new to resale units would perform better; they should have appreciated from more time in the market.

Here are the holding periods for the various transactions:

| Project | New Sale to Resale | New Sale to Sub Sale | Grand Total |

| AMBER 45 | 4.4 Years | 3.2 Years | 4.3 Years |

| AVENUE SOUTH RESIDENCE | 4.0 Years | 3.1 Years | 3.9 Years |

| BUKIT 828 | 4.0 Years | 1.6 Years | 2.8 Years |

| DAINTREE RESIDENCE | 3.7 Years | 3.3 Years | 3.4 Years |

| FOURTH AVENUE RESIDENCES | 3.6 Years | 3.6 Years | 3.6 Years |

| JADESCAPE | 4.1 Years | 3.7 Years | 3.8 Years |

| JUI RESIDENCES | 4.6 Years | 3.4 Years | 4.3 Years |

| KOPAR AT NEWTON | 4.0 Years | 3.6 Years | 3.6 Years |

| MARGARET VILLE | 4.4 Years | 3.5 Years | 4.3 Years |

| MAYFAIR GARDENS | 4.6 Years | 4.1 Years | 4.3 Years |

| MIDWOOD | 3.2 Years | 3.1 Years | 3.1 Years |

| NYON | 3.9 Years | 3.5 Years | 3.8 Years |

| OLLOI | 3.9 Years | 2.2 Years | 3.1 Years |

| PARC ESTA | 4.3 Years | 3.7 Years | 3.8 Years |

| PARK COLONIAL | 4.9 Years | 3.7 Years | 4.3 Years |

| REZI 24 | 3.5 Years | 4.0 Years | 3.9 Years |

| STIRLING RESIDENCES | 4.3 Years | 3.6 Years | 4.0 Years |

| THE ANTARES | 3.7 Years | 3.9 Years | 3.8 Years |

| THE GARDEN RESIDENCES | 4.1 Years | 3.4 Years | 4.0 Years |

| THE JOVELL | 4.2 Years | 3.5 Years | 3.7 Years |

| THE TAPESTRY | 4.6 Years | 3.3 Years | 4.4 Years |

| THE VERANDAH RESIDENCES | 5.7 Years | 4.7 Years | 5.0 Years |

| TREASURE AT TAMPINES | 3.8 Years | 3.7 Years | 3.7 Years |

| TWIN VEW | 4.9 Years | 3.4 Years | 4.2 Years |

| VERDALE | 3.6 Years | 3.4 Years | 3.5 Years |

| WHISTLER GRAND | 4.1 Years | 3.5 Years | 3.8 Years |

| Average | 4.3 Years | 3.7 Years | 3.9 Years |

Note that for Midwood, the average holding period between new to sub sale and new to resale is not very different. As such, the holding period doesn’t seem to have mattered for this specific condo.

Overall, however, the results are better by around 1.4 per cent, if you wait till after TOP to sell. This comes from a difference of around eight months in the holding period.

Overall, the results suggest that the timing of this short scale doesn’t really have an effect

Due to factors like the Sellers Stamp Duty (SSD), and the unreliability of finding sub sale buyers, it may be best to stick to a fundamental strategy: buy when you have holding power, and can ride out downturns.

(The SSD imposes a tax of 12 per cent of the sale price if a unit is sold within the first year of purchase. This decreases to eight per cent and four per cent in subsequent years, which explains why most sub sales occur in the fourth year, after the SSD period).

Ultimately, the decision usually depends on the specific project. For a luxury new launch condo with fewer competing units and a promising outcome (at least, from what you can see on the outside), waiting might be beneficial. Buyers in this segment often make emotional purchases and may be willing to pay a premium if they like what they see.

For a mass-market new launch, this may be more timing-dependent. If you bought early while many others purchased later, it might be wise to sell before a large number of listings hit the market. Even if there’s a chance of securing a higher price later, the risk may not be worth it in this scenario.

A final point of consideration: private property prices are starting to rise at a slower pace. It’s proving difficult to go past $2,200 psf, and this will have an effect on sub sale transactions. So again, buyers today should ensure they’re prepared to stay longer if necessary: you may have to sell much further past the TOP date than you’d expect.

For more news on the Singapore private property market, or if you have questions about your sale or purchase, do reach out to Stacked for help. If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from New Launch Condo Analysis

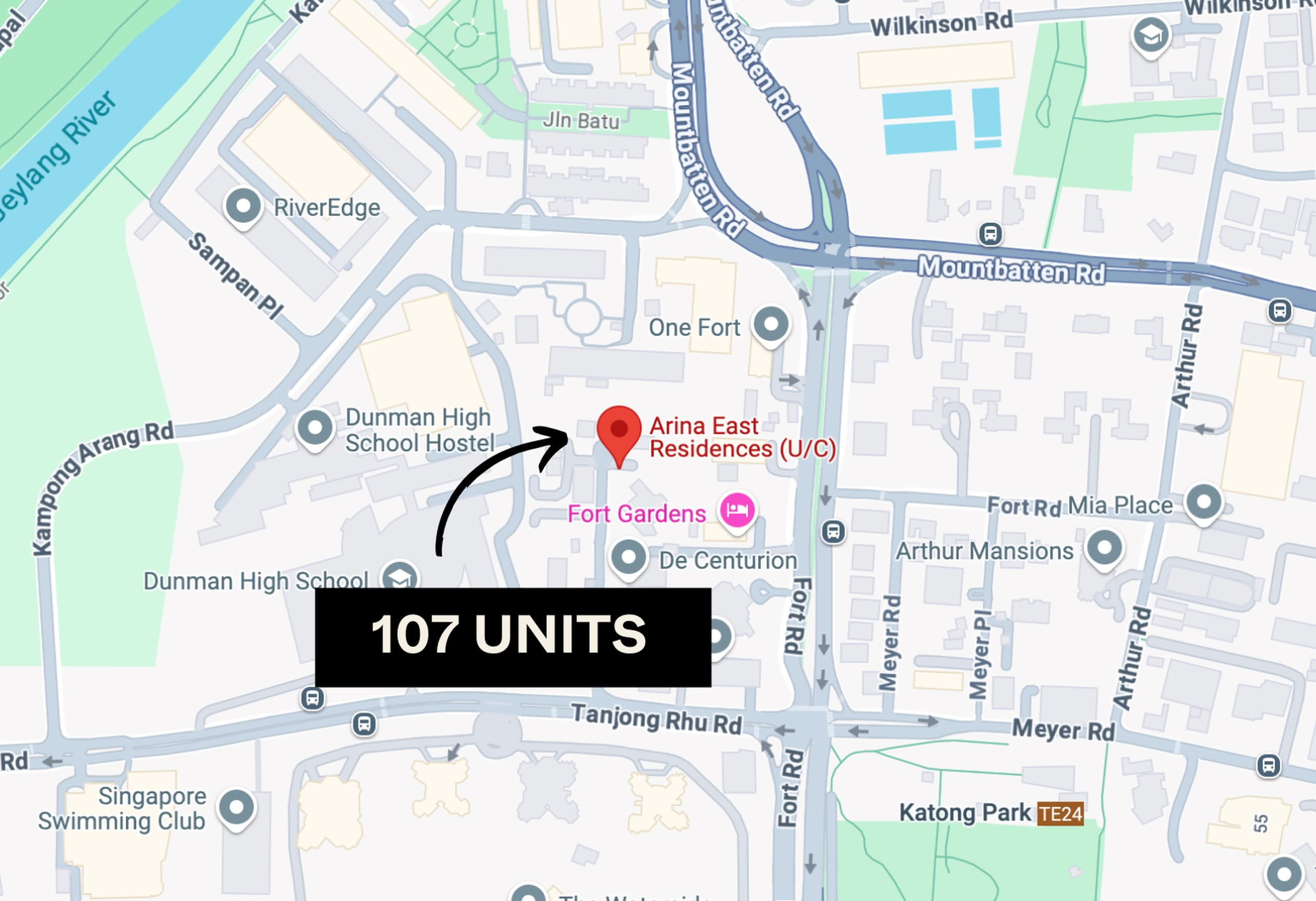

New Launch Condo Analysis Is Arina East Residences Worth A Look? A Detailed Pricing Review Against District 15 Alternatives

New Launch Condo Analysis This New Launch Condo In The East Is 4-Minutes From Katong Park MRT: A Preview Of Arina East Residences

New Launch Condo Analysis Is Bloomsbury Residences Worth A Look? A Detailed Pricing Review Against One-North Condo Alternatives

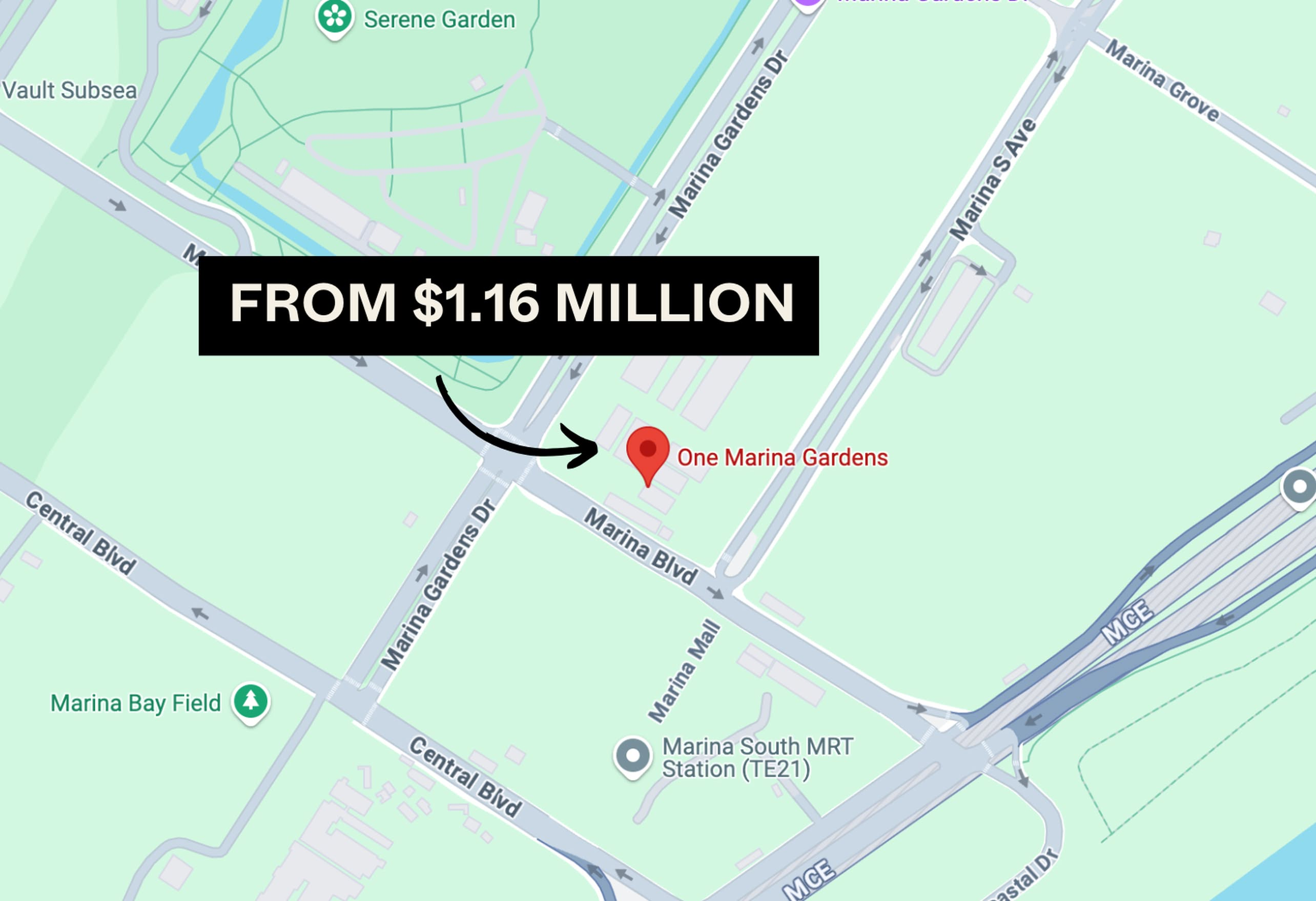

New Launch Condo Analysis Is The 937-Unit One Marina Gardens Condo Worth A Look? (Prices Start From $1.16m)

Latest Posts

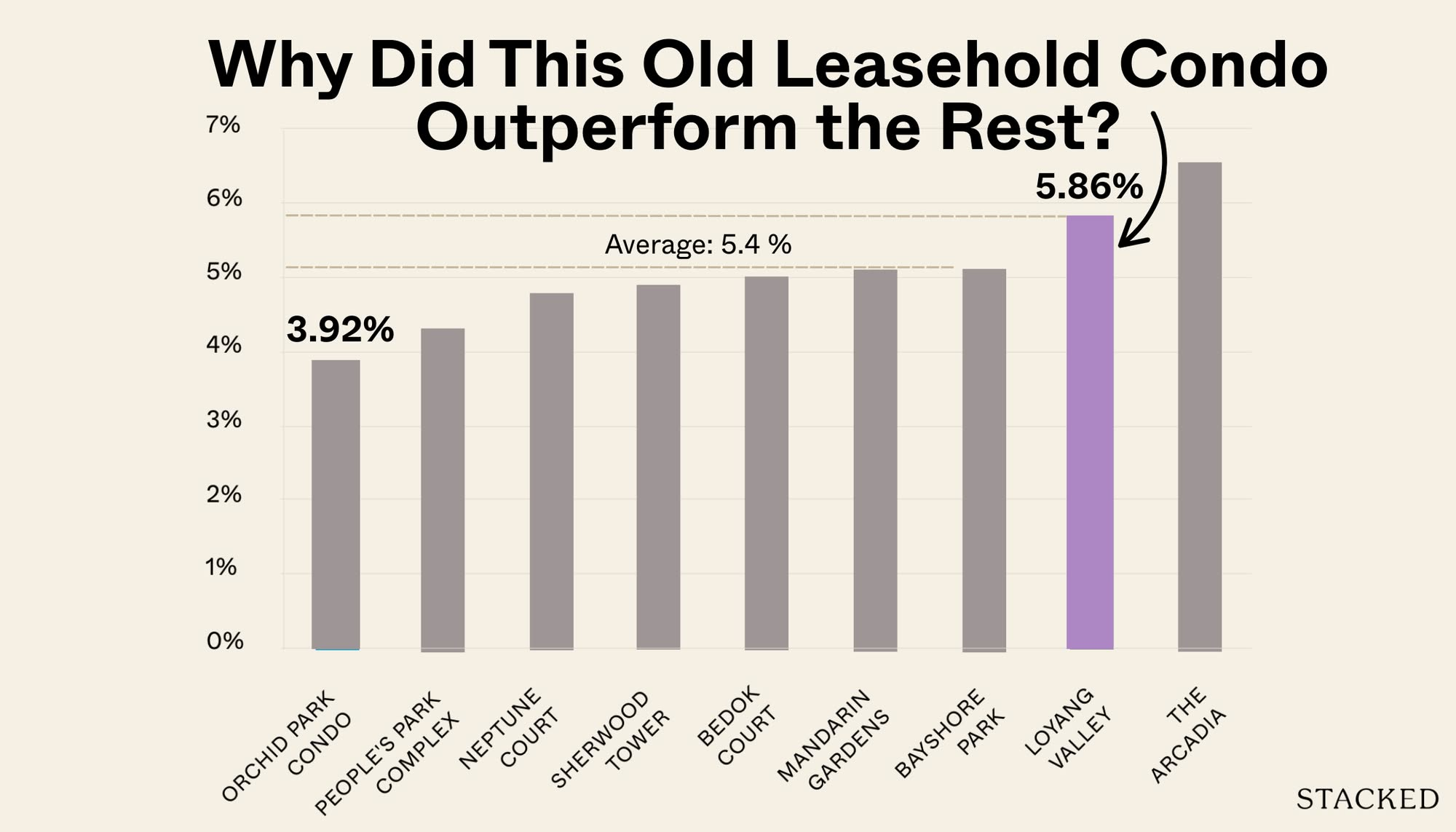

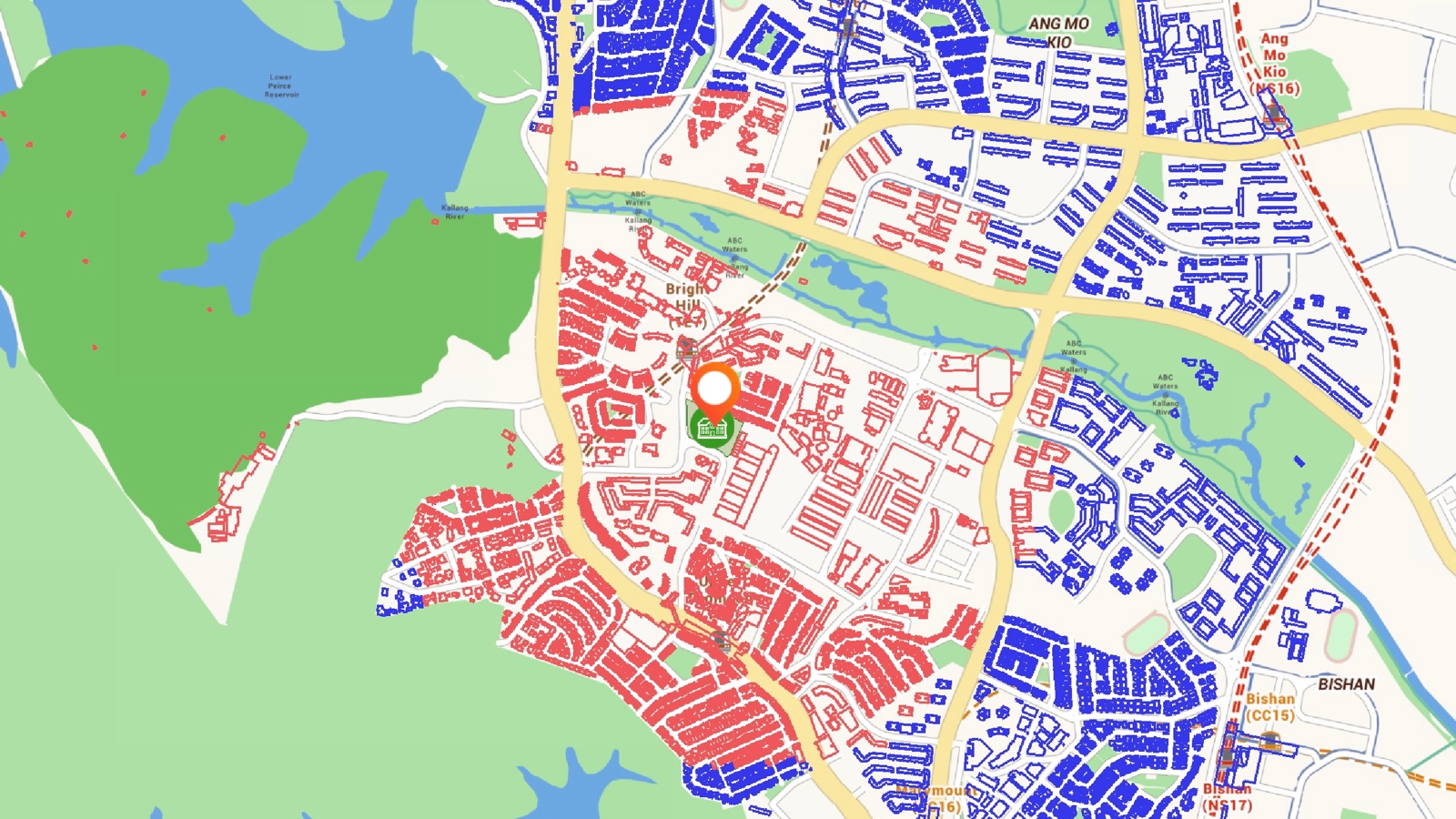

Pro Why This 40-Year-Old Leasehold Condo Beat Newer Developments: A Case Study Of Loyang Valley

On The Market 50 New Launch Condos With Balance Units Remaining In 2025 (From $1,440 PSF)

Singapore Property News This West-Side GLS Plot Just Got A $608M Bid And 6 Bidders: Why Lakeside Drive Bucked The Trend

Landed Home Tours Touring A Rare Stretch of Original 2-Storey Freehold Terrace Homes At Joo Chiat Place From $3.02m

Singapore Property News The 1KM Primary School Rule In Singapore: Fair Game Or Property Power Play?

Singapore Property News 1,765 Punggol Northshore HDB Flats Reaching MOP: Should You Sell Quickly or Wait?

Overseas Property Investing Love Without A BTO Flat: The Tough Housing Choices Facing Mixed-Nationality Couples In Singapore

Property Market Commentary I Reviewed HDB’s Showroom For 4 And 5-Room Flats. Here’s What Future Homeowners Should Know

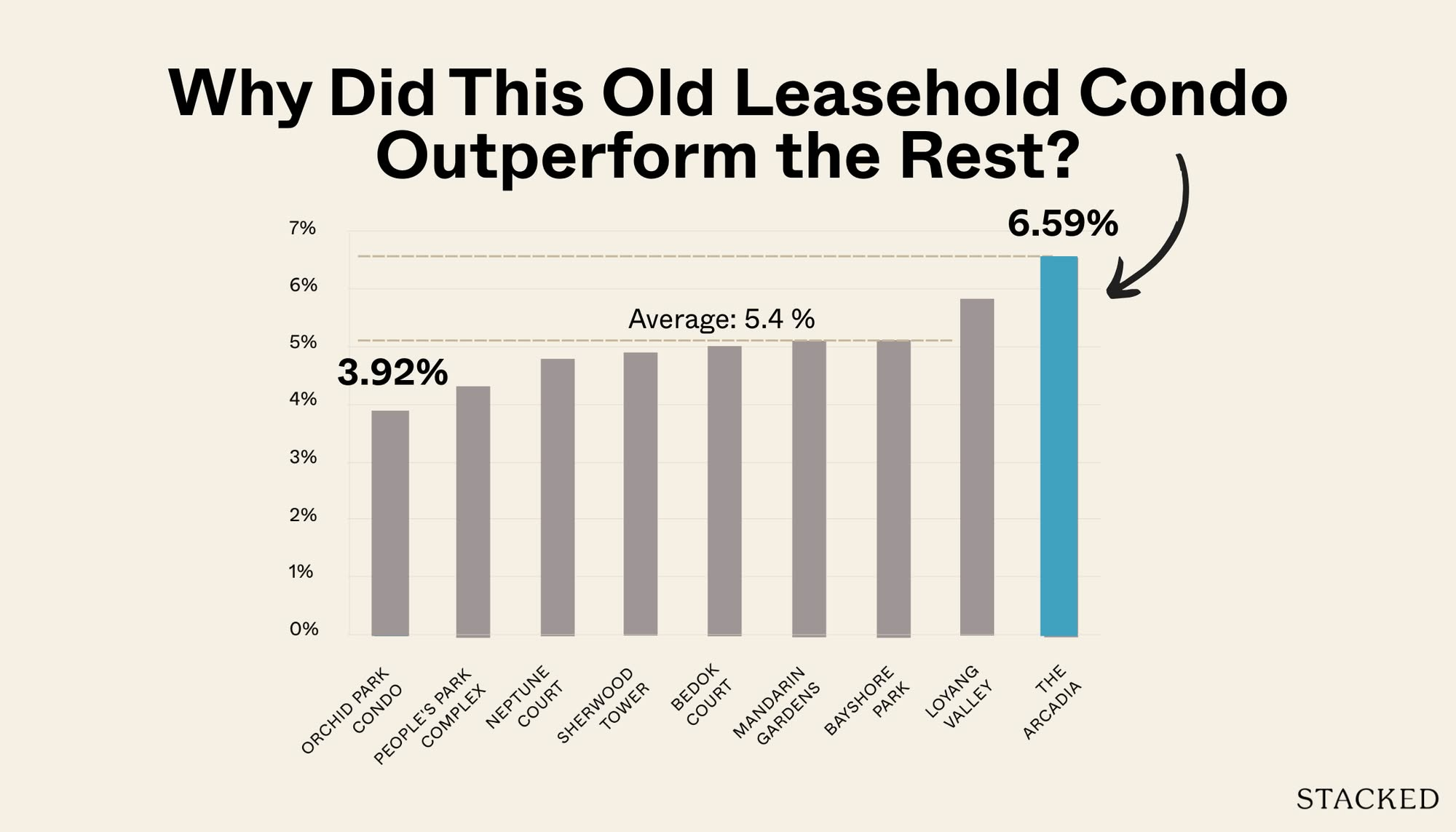

Pro Can 30+ Year-Old Leasehold Condos Still Perform? The Arcadia’s Surprising Case Study

Singapore Property News $1.658 Million For 5-Room HDB Loft In Queenstown Sets New Record

On The Market 5 Lesser-Known Freehold 3-Bedroom Units Priced Under $2 Million

Property Market Commentary The Biggest Misconceptions About Buying Property In Singapore’s CCR In 2025

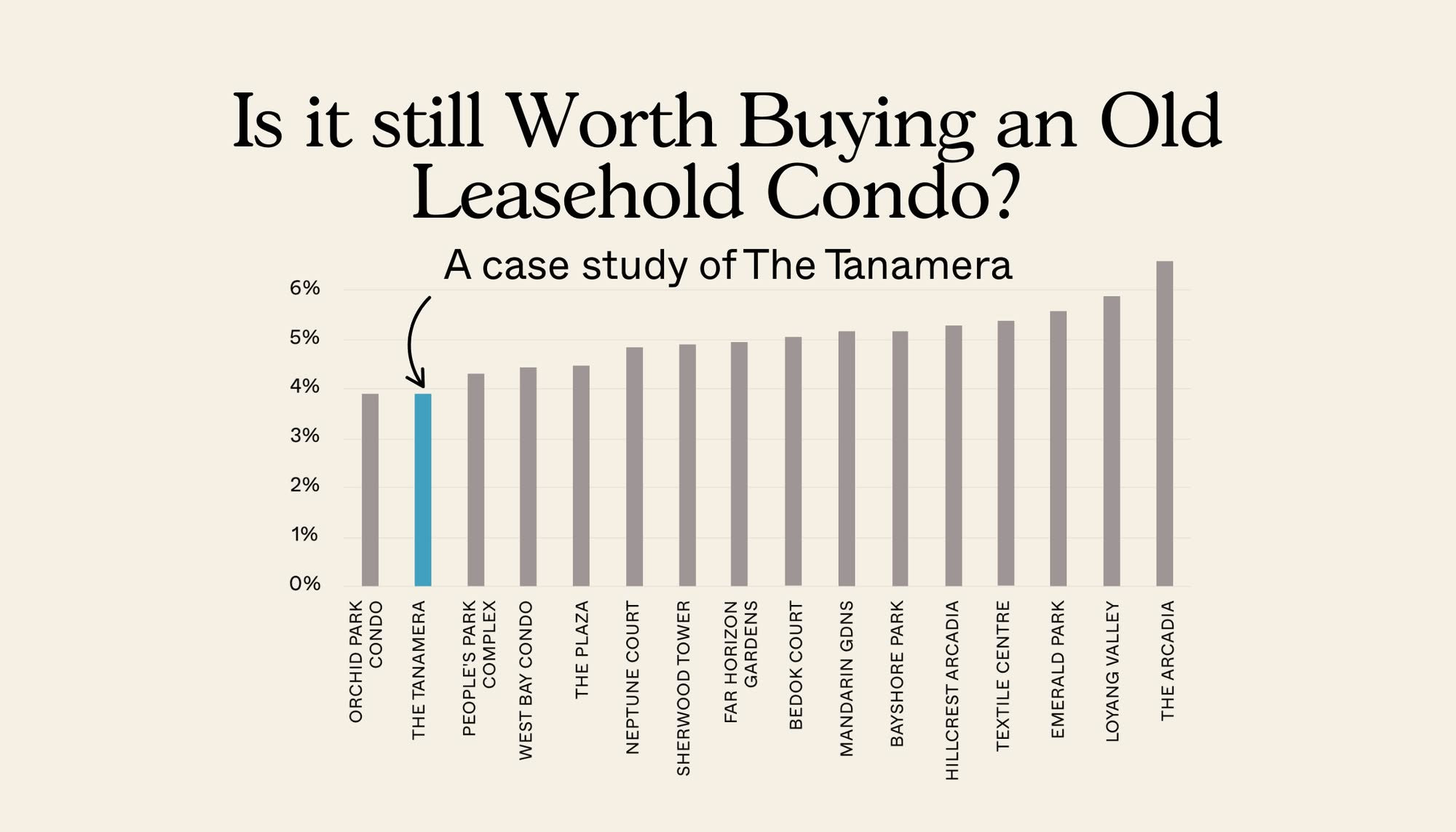

Pro How Have Older Leasehold Condos Performed Compared To Newer Ones? A Case Study Of The Tanamera

Editor's Pick Why We Chose A $1.23 Million 2-Bedroom Unit At Parc Vista Over An HDB: A Buyer’s Case Study

Property Advice The Surprising Reasons Some Singaporean Buyers Are Choosing Smaller Condo Units (Even When They Can Afford More)