4 Important Lessons From The Thomson Road Building Demolition. Yes, It’s About En-Bloc.

April 20, 2021

There was a bit of a shocker this week, when the government announced the demolition of 68 to 74 Thomson Road. While this is an old building, it’s also a freehold property; and because of its good location (it’s just across the road from United Square), this could be a devastating loss for the owners. This property has been noted for its en-bloc potential, given its prime location and proximity to United Square Mall. What happened here presents some important lessons for homeowners and investors alike:

What happened at 68 – 74 Thomson Road?

68 – 74 Thomson Road is a mixed-use building, completed in 1964. It’s a small development (8,352 sq. ft. in total), located about six metres from where the new North South Corridor (NSC) tunnel will be dug through Thomson.

The proximity could impact the old building, but studies of it already took place in 2013. At the time, it was deemed able to handle the construction.

In 2020 however, Land Transport Authority (LTA) engineers conducting their impact assessment came to a somewhat different conclusion – they said the building’s foundations had to be reinforced.

The owners and tenants were asked to temporarily move out, which occurred in February this year. From what we understand, some owner-occupiers and tenants even left most of the existing furnishings intact, expecting to return.

Last Friday, however, the owners were given notice that the entire development would be demolished. They would be given compensation in accordance with the Land Acquisition Act, although the exact amount has yet to be disclosed.

(The Act states that it should be based on the market value of the land, but this is likely to open up a few disputes).

How much is the land plot likely to be worth?

There isn’t any existing price data on 68-74 Thomson Road. However, we did manage to locate some nearby properties, to get a sense of the price.

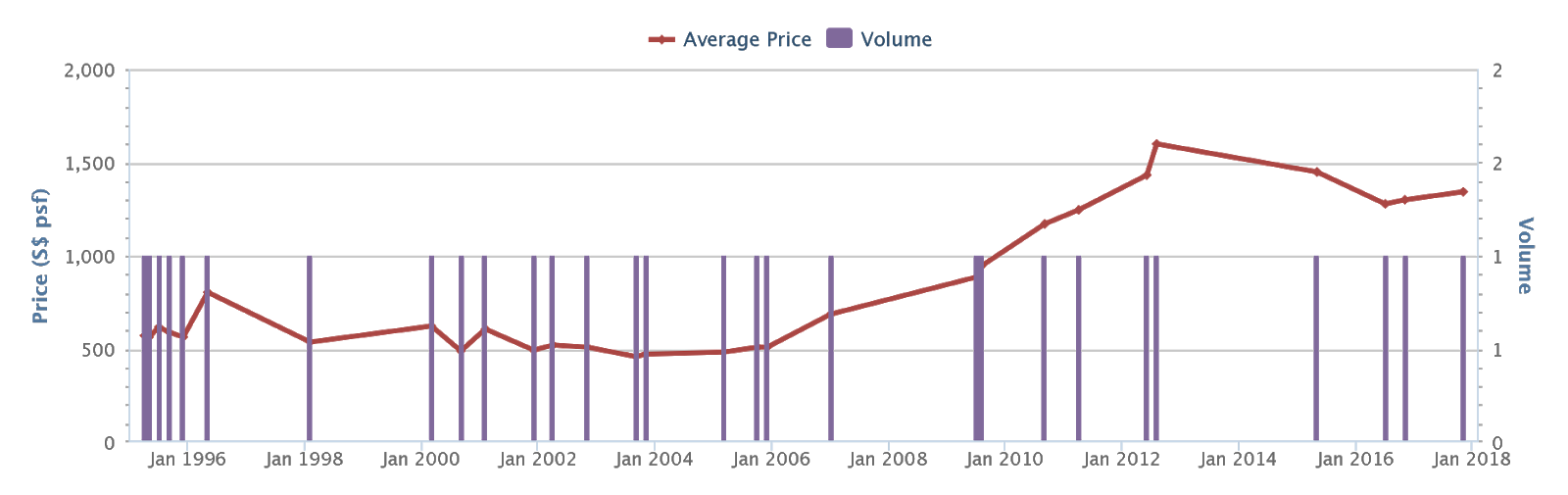

The closest point of comparison would be Lion Towers and Derbyshire Heights, which are adjacent. While transaction volumes are low, these surrounding developments are both also freehold:

Lion Towers

Location: Essex Road (District 11)

Lease: Freehold

Completion: 1974

Number of units: 52 units

The last transaction in 2018 was at $1,343 psf.

Derbyshire Heights

Location: Derbyshire Road (District 11)

Lease: Freehold

Completion: 2004

Number of units: 24 units

The last transaction in 2020 was at $1,339 psf.

It’s possible that, if the valuation cleaves close to this, it would be at around the same range (approx.$1,400 psf). If that’s the case, it would only come to roughly $12 million for the entire development.

There are 12 residential units here: 68A-C, 70A-C, 72A-C and 74A-C. We don’t have the exact unit size, but based off old online listings, each unit is around 1200 sqft, so an owner of such a unit size is estimated to receive around $1.68m (again, this is just an estimate).

A bit of a raw deal, given it has a prime location close to a mall / office.

(This is just a guess, so we could of course be wrong, and the authorities may be much more generous).

How much would a new replacement home cost?

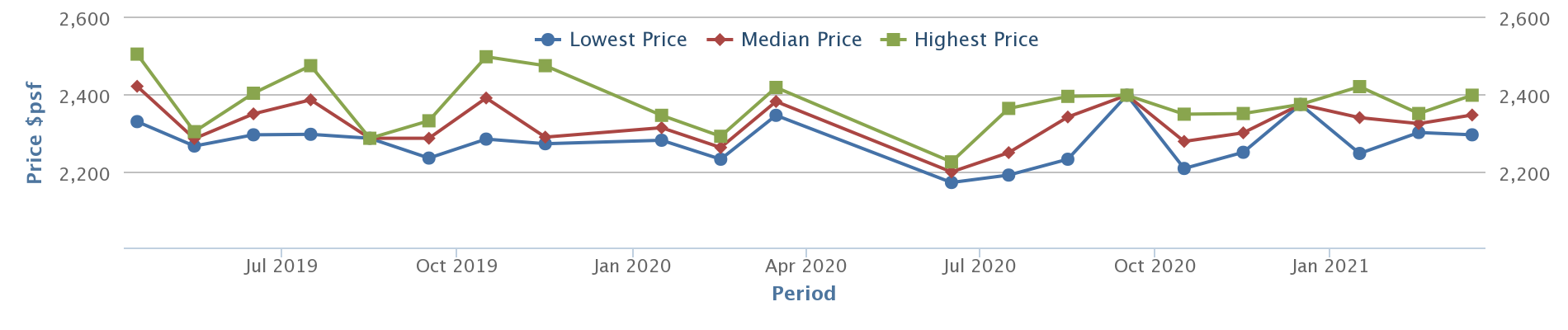

Let’s say the owner-occupiers want to buy a new condo in roughly the same area. This would Fyve Derbyshire, which is located just around 150 metres away (it’s also a freehold condo). This is how much it would cost them:

Fyve Derbyshire

Location: Derbyshire Road (District 11)

Lease: Freehold

Completion: Est. 2022

Number of units: 71 units

Median developer pricing was at $2,346 psf, with the lowest price at $2,295 psf, and the highest at $2,397 psf.

| DATE | UNIT AREA (SQFT) | PRICE (S$ PSF) | PRICE (S$) |

|---|---|---|---|

| 4 APR 2021 | 657 | 2,390 | $1,569,000 |

| 3 APR 2021 | 592 | 2,372 | $1,404,000 |

| 24 MAR 2021 | 657 | 2,295 | $1,506,925 |

| 14 MAR 2021 | 797 | 2,397 | $1,909,000 |

| 25 FEB 2021 | 936 | 2,301 | $2,155,000 |

| 5 FEB 2021 | 592 | 2,350 | $1,391,000 |

As you can see, the price disparity would be huge, if 68-74 Thomson really is saddled with a value of around $1,400 psf.

Some key lessons we can learn from this:

- Freehold doesn’t always mean forever

- Look beyond unit maintenance for older properties

- Never assume you can exit via an en-bloc sale

- Keep aware of changes to the neighbourhood

1. Freehold doesn’t always mean forever

The Land Acquisition Act applies whether your property is freehold, or only in the first few years of a 99-year lease. If the government needs your land, they can take it with fair compensation (i.e., whatever the approved valuer says its worth).

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

“We Calculated Our Interest Payment Alone To Be $110k In 10 Years” Why We Chose To Pay Off Our Home Loan Early

Most Singaporeans resign themselves to paying off a home loan for 25 to 30 years. In most cases, the home…

So if you’re under the impression that a freehold property will be passed down for generation upon generation, there’s a good chance you’re wrong. Even if an en-bloc sale doesn’t occur at some point (few condos make it past 40 years without collective sale), bear in mind that an increasingly packed Singapore may prompt the authorities to re-acquire it.

As an aside, not all forms of “freehold” are equal.

This is why some investors are willing to pay a premium for freehold properties that are conserved, or within conservation areas (at present, these include Boat Quay, Chinatown, Kampong Glam, and Little India). This isn’t just for the added prestige. These investors are simply aware that, due to conservation efforts, it’s less likely that an expressway, MRT track, etc. will be built through their neighbourhood or property.

2. Look beyond unit maintenance for older properties

68-74 Thomson Road was built on shallow foundations. This refers to foundations that transfer the building’s load only to the ground’s surface, rather than to a deeper layer.

From our enquiries, this sort of foundation is more common among older properties, which predate later condos (the first condos only appeared in around the 1970s). As such, it’s more likely to be found among older walk-up style apartments, as opposed to a full-fledged condo.

In any case, there was some early warning for 64-78 Thomson Road. This goes back to 1994, when parts of the building had to be propped up with piles; this was following the demolition of a nearby building.

The Singapore property market is used to a high standard of building safety, so we rarely question such issues when they happen; it’s possible that subsequent buyers weren’t even made aware. The study done in 2013, which gave the building the green light, probably led to even greater confidence.

But as this recent example demonstrates, you should take note of these details when buying older buildings. If work has been done to reinforce the structure, always find out why; these can reflect on issues that can’t be fixed.

3. Never assume you can exit via an en-bloc sale

Some owners of 64-78 Thomson Road had reasoned the property was an ideal prospect for en-bloc sale. They are absolutely right – without this turn of events, their property is in a perfect location for redevelopment: it’s across the road from the mall, and in one of Singapore’s most prime locations.

The development was also small, with few actual home owners (we understand that there were only 16 units (commercial and residential), 14 were leased out. This composition suggests it would have been easier to achieve consensus, in any collective sale attempt.

However, even with all the proverbial stars aligned, any hope of an en-bloc sale is now gone with the land’s acquisition; and it’s likely that simply market value will be much lower than what an en-bloc would fetch.

It’s a good reminder that plenty of things can stop a collective sale; and that you shouldn’t stake too much of your portfolio on it.

4. Keep aware of changes to the neighbourhood

Most people don’t go beyond surface level checks, such as knowing which new malls are appearing nearby, when the MRT station will be done etc.

It’s important to go beyond this, such as knowing that Orchard Road is being revamped, or that Woodlands is becoming a regional centre. This isn’t just to spot investment potential; it’s because it highlights issues such as new roads, or new MRT tracks.

It’s important to take note of where these upgrades will happen, and if your property will be affected. Even if it doesn’t result in your property being acquired, change can bring new disamenities. For example, having an MRT station built near your condo could improve rentability; but it could also mean having a raised track nearby, which rattles all the windows on a given floor and facing.

So when you research future upgrades to the neighbourhood, don’t just focus on the positives. Consider the negatives as well, such as whether you’ll face increased road congestion, or if nearby construction would impact your property.

In defence of 64-78 Thomson Road, the owners were told in 2013 that the building was good to remain; but now you know to take such news as a skeptic.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What does the demolition of 68-74 Thomson Road teach about freehold properties?

Why should homeowners consider factors beyond unit maintenance when buying older buildings?

Can owners rely on en-bloc sales to exit their property profitably?

How important is neighborhood development awareness for property owners?

What should owners of older properties do before purchasing or investing?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Singapore Property News Taking Questions: On Resale Levies and Buying Dilemmas

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments