Would You Still Pay More For A Private Condo, If The EC Next Door Looked The Same?

July 27, 2025

“Which crazy person will buy this condo, the EC next door is $X psf cheaper.”

That’s the kind of offhand remark that sends prospective buyers spiralling into existential dread; and I’ve heard it more times than I care to admit. And I get it, because of the direction ECs have been going in.

Yes, there are differences – ECs are subsidised, there’s a five-year MOP for the first batch of buyers, and so on; but still, the optics are brutal. ECs today have much better finishing and detail than their counterparts from 20+ years ago. Same stylish facades, same landscaping, and facilities that can match their private counterparts. In blind guessing games, where I’ve asked people to guess whether it’s an EC or fully private from the photos, most of them struggle to tell.

When you throw in the lower price point, there’s a natural fear of how future buyers will react. It’s not just theoretical:

In Punggol, Prive – a resale EC – is now averaging around $1,455 psf, while nearby private condo River Isles is at about $1,444 psf. In fact, a 1,087 sq. ft. unit at Prive was recently sold for $1.72 million, beating out a larger 1,173 sq. ft. unit at River Isles that sold for $1.7 million. And it’s not a one-off.

Over at Flo Residence, another private condo in the area, average prices are $1,356 psf. But that’s now below two other ECs in the same neighbourhood: The Terrace at $1,409 psf, and Twin Waterfalls at a whopping $1,489 psf.

Naturally, this raises questions. What happens when a fully private condo is right next to an EC with similar design, similar offerings, but a much lower price? What does that do to buyer perception, or future resale value?

One effect is that private condos neighbouring ECs may, at a casual glance, seem to be underperformers. This is because the nearby EC, which started off at lower prices, will tend to see much higher appreciation. If buyers aren’t careful or savvy enough to draw the distinction, the private condo can come off looking much worse – especially if the buyer does a simplified comparison (e.g., comparing everything within a few kilometres, when there are multiple ECs nearby)

One instinctive response is: developers need to differentiate more. But the reality is, given current land prices and squeezed margins, that may not be sustainable. There’s only so much a developer can do before the costs outweigh the returns.

The huge profits EC owners have been seeing could also trigger some changes ahead.

First, we might see increasingly stronger competition for EC land parcels. Because ECs are frankly an easy sell, developers may start bidding more aggressively for these sites, driving up launch prices. If land costs rise, the price gap between ECs and private condos could naturally close over time.

Second, we could see policy changes to cool the upside. This can sometimes happen purely for optics; just as some people decry the “lottery effect” of getting a good BTO flat, the same ire may be directed toward ECs in time. When that happens, we may perhaps see tweaks like extending the EC MOP period to 10 years. This would delay the point at which ECs can be resold to the open market, possibly moderating demand.

More from Stacked

How Will CPF Changes In 2025 Affect Your Housing Decisions In Singapore?

Several changes to the Central Provident Fund (CPF) have taken effect from 2025, prompting questions about their impact on housing…

In the meantime, though, private condos still need to lean into areas where ECs can’t compete as easily:

- Layouts that feel genuinely custom-designed (e.g. dumbbell layouts, enclosable kitchens, large balconies with actual usability)

- Design identity that feels cohesive and bespoke—not just another “50-metre lap pool and aqua gym” copy-paste

- Higher construction standards like proper soundproofing, engineered wood flooring, or real marble

And so forth. This might help to mitigate the sense of cold feet, as buyers stare down the price gap next door and wonder: what if I’m on the wrong side of this comparison chart, five years from now?

This will be an ongoing challenge for private developers going forward: justifying their prices versus subsidised counterparts, which are coming ever closer in terms of quality.

Meanwhile, in other property news this week:

- Prepare yourself for the July 2025 BTO launch, with this handy guide reviewing the various projects.

- New HDB policies are improving the ballot chances of singles and second-timers alike; here’s what you need to know.

- Canberra Crescent Residences has launched; but is it worth its price tag given the less-mature neighbourhood? Here’s the answer.

- Join our Stacked Pro readers as we analyse the pricing of Promenade Peak and how it compares to nearby properties.

Weekly Sales Roundup (14 July – 20 July)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| UPPERHOUSE AT ORCHARD BOULEVARD | $7,657,000 | 2056 | $3,724 | 99 years |

| MEYER BLUE | $6,106,000 | 1905 | $3,205 | FH |

| THE ROBERTSON OPUS | $5,390,000 | 1539 | $3,502 | 999 years |

| WATTEN HOUSE | $5,063,000 | 1539 | $3,289 | FH |

| ONE MARINA GARDENS | $5,000,000 | 1647 | $3,036 | 99 yrs (2023) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILL HOUSE | $1,298,000 | 431 | $3,015 | 999 yrs |

| THE ROBERTSON OPUS | $1,369,000 | 431 | $3,180 | 999 yrs |

| ELTA | $1,378,000 | 506 | $2,724 | 99 yrs (2024) |

| UPPERHOUSE AT ORCHARD BOULEVARD | $1,395,000 | 474 | $2,945 | 99 yrs |

| GRAND DUNMAN | $1,412,000 | 549 | $2,572 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SHAMROCK PARK | $13,102,820 | 3157 | $4,150 | FH |

| 3 ORCHARD BY-THE-PARK | $11,106,900 | 2583 | $4,299 | FH |

| WATTEN ESTATE | $7,800,000 | 3302 | $2,362 | FH |

| CHUAN GARDEN | $6,400,000 | 4878 | $1,312 | FH |

| THE SOVEREIGN | $6,150,000 | 2637 | $2,332 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SEASTRAND | $700,000 | 581 | $1,204 | 99 yrs (2011) |

| HARBOUR SUITES | $700,000 | 420 | $1,667 | FH |

| RIVERFRONT RESIDENCES | $765,000 | 463 | $1,653 | 99 yrs (2018) |

| SELETAR PARK RESIDENCE | $785,000 | 592 | $1,326 | 99 yrs (2011) |

| OKIO | $810,000 | 431 | $1,881 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE SOVEREIGN | $1,845,900 | 2637 | $700 | $4,304,100 | 20 Years |

| MOUNT FABER LODGE | $1,100,000 | 2454 | $448 | $2,906,888 | 27 Years |

| WATTEN HILL | $2,200,000 | 2669 | $824 | $2,800,000 | 15 Years |

| THE ESTA | $885,000 | 1313 | $674 | $2,302,800 | 19 Years |

| HAIG COURT | $881,000 | 1442 | $611 | $2,119,000 | 20 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| HELIOS RESIDENCES | $4,026,090 | 1281 | $3,143 | -$796,090 | 18 Years |

| MARINA BAY SUITES | $3,573,000 | 1572 | $2,274 | -$523,000 | 15 Years |

| MARINA BAY SUITES | $4,351,000 | 2056 | $2,116 | -$501,000 | 15 Years |

| PATERSON SUITES | $6,094,500 | 2196 | $2,775 | -$394,500 | 12 Years |

| ECHELON | $1,037,000 | 452 | $2,294 | -$119,000 | 12 Years |

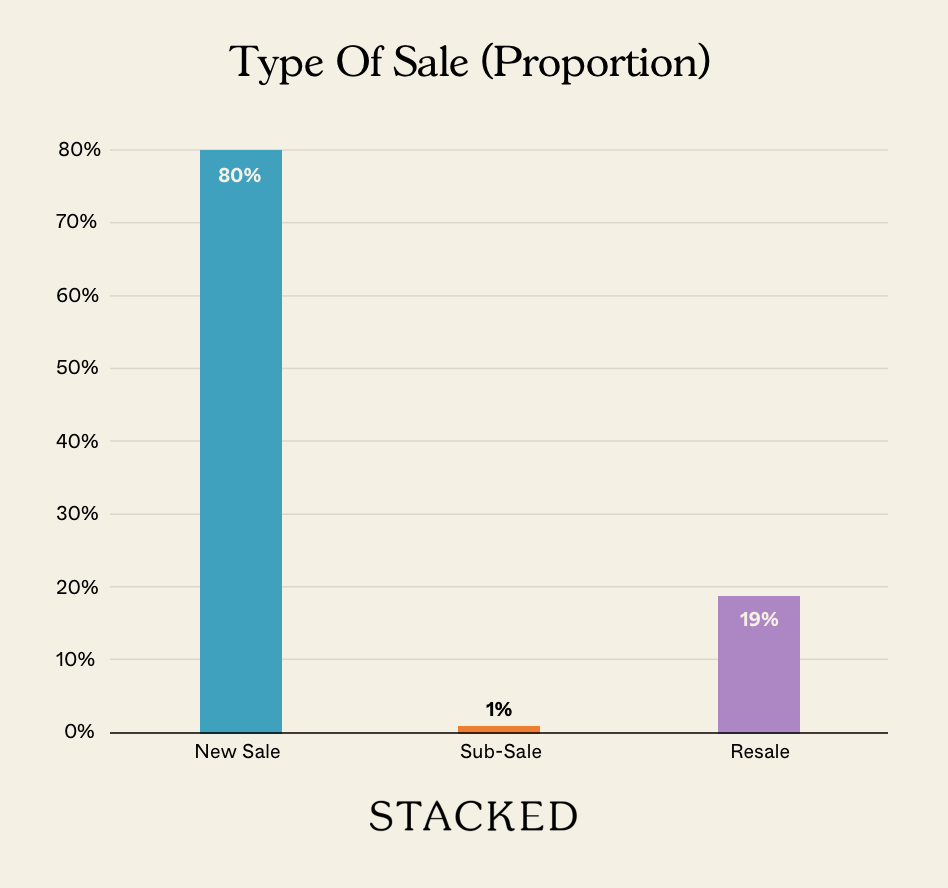

Transaction Breakdown

Follow us on Stacked for in-depth reviews of new and resale properties alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Would I still pay more for a private condo if the EC next door looks the same?

How do ECs compare to private condos in terms of quality and features?

What impact does the presence of nearby ECs have on private condo prices?

Are there ways for private condos to stand out against ECs with similar designs?

Could policy changes affect the future prices of ECs and private condos?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

1 Comments

Your 1st on the list of Top 5 most expensive resale this week is a FH landed property in Namly while the rest are non-landed. Can’t really compare.