Sweden Sells Land For Just 13 Singapore Cents… What’s The Catch?

-

Ryan J

Ryan J

- September 22, 2024

- 4 min read

- Leave comment

4 min read

4 min read

Fancy a landed property that’s cheap, scenic, and really doesn’t need air-conditioning?

Any of you with classic Singaporean “polar bear” syndrome? By that I mean you make you scream when someone raises the air-con past 22 degrees. There’s now a solution that will keep you cool, and make you a property owner to boot: and that’s to buy real estate at cut-rate prices in Sweden.

According to CNN, Götene, about 320 kilometers southwest of Stockholm, is selling 29 plots of land with prices starting at just 1 krona, or 13 Singapore cents, per square meter (11 square feet). Most plots will come to S$63,500.

Note that this isn’t for a house per se, it’s for the land – and from what we understand, you are obliged to build a house on it within two years. But construction of most houses in the area (the town has a population of just around 5,000) is said to cost just between S$381,000 to S$508,000; comparable with cheaper HDB flats.

Alternatively, if construction seems too much trouble, just look up how cheap some of the existing homes are. Here’s an Instagram account for it – and notice how these landed beauties would probably cost you four or five times the price in Singapore.

As always, there must be a catch, so I cast around a bit and asked on the Internet; and you can also see some past conversations about it on Reddit (the thread’s about three years old, so this isn’t a new phenomenon). The biggest issues mentioned are the harshness of the weather – which may be a bit much even for you polar bears – and the desolation. If we did a review of some of these places, I’d have to tell you the nearest train station involves hiring Bear Grylls and a tundra-dwelling tribe.

Apparently, some of the locations are so frigid, it’s potentially unlivable in the midst of winter; and a substantial amount of maintenance goes into keeping the house standing (pipes freeze, windows chip, and yes, even concrete cracks). The ulu factor is also extreme enough to be a health concern: if you have some kind of medical emergency, it could be three or four hours to town – definitely not the kind of thing for the elderly, but fit young Singaporeans may be up for it.

There’s also the Singaporean tendency to think of housing as investment, which could make all this seem… well, decadent. In all honesty, it’s the most affluent Singaporeans who think in terms of pure home ownership. We’re hardwired to think of property as being part comfort, part investment – otherwise it feels like too much money to waste.

And when it comes to cheap properties in Sweden – as is the case in Italy, Japan, Detroit, etc. – the investment value is likely nil. Barring a slow miracle (i.e., the barren surroundings transform into vibrant cities), you’re not likely to recoup your costs; and the property likely won’t be needed for Airbnb style arrangements, unless someone’s training a corps of winter commandos.

Various issues aside, I think this is an example of where Singapore’s size works to our disadvantage. In many ways, being a small country has advantages in housing: closer proximity to amenities, more neighbours (which adds to security), and a better ability to ensure each neighbourhood sees the right upkeep.

But it also means that, unlike Sweden or Japan or Italy (all places where they’ve had super-cheap housing to draw fresh blood), we have no rural space to run to. When prices get too high, Tengah or Johor is about as far as we can flee – there’s no “fading village” where the price per square foot is lower than your kopi peng.

Who knows: if private home prices keep going at the current rate, more Singaporeans may start looking at more exotic options.

Meanwhile in other property news…

- Affordable resale ECs may be the only way up the property ladder these days. We looked for the most affordable ones by unit sizes here.

- Is 8@BT a good buy? We compare it to its neighbours in Beauty World, to see if it’s a bargain.

- How ready are we for an ageing crisis in Singapore? Here’s a frank look at what can happen when someone elderly goes missing.

- Moving from a landed house to a condo means a lot less space; here’s one family’s experience of the process.

Weekly Sales Roundup (09 September – 15 September)

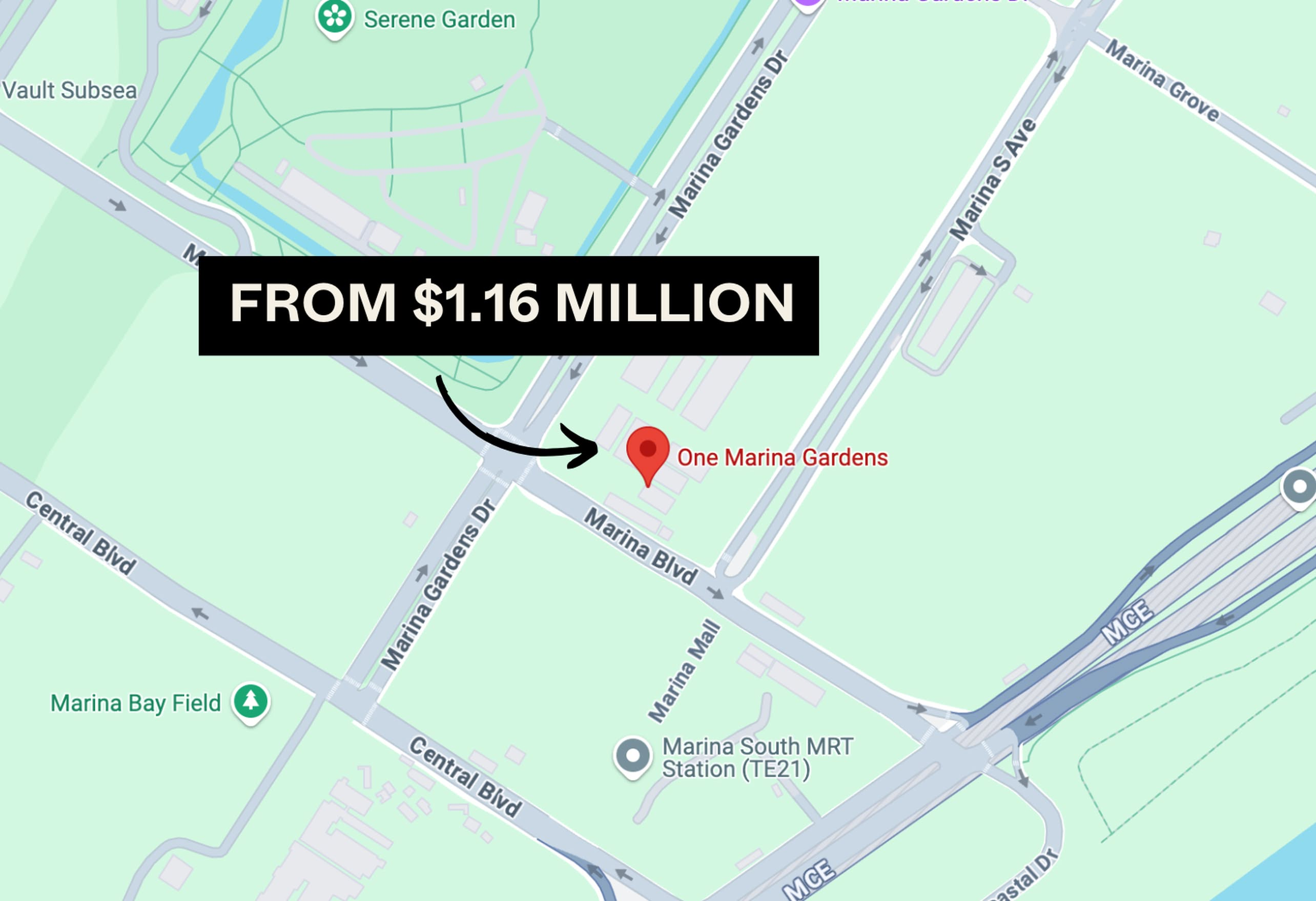

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANNINGHILL PIERS | $5,606,000 | 1959 | $2,862 | 99 yrs (2021) |

| 19 NASSIM | $5,550,000 | 1475 | $3,764 | 99 yrs (2019) |

| PINETREE HILL | $3,681,000 | 1464 | $2,515 | 99 yrs (2022) |

| THE RESERVE RESIDENCES | $3,472,000 | 1378 | $2,520 | 99 yrs (2021) |

| TEMBUSU GRAND | $3,330,000 | 1432 | $2,326 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KASSIA | $1,161,000 | 549 | $2,115 | FH |

| HILLOCK GREEN | $1,292,000 | 517 | $2,501 | 99 yrs (2022) |

| TEMBUSU GRAND | $1,437,000 | 527 | $2,725 | 99 yrs (2022) |

| LENTORIA | $1,555,000 | 732 | $2,124 | 99 yrs (2022) |

| HILLHAVEN | $1,592,897 | 797 | $2,000 | 99 yrs (2023) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ORCHARD RESIDENCES | $10,250,000 | 2852 | $3,593 | 99 yrs (2006) |

| THE LUMOS | $9,039,360 | 3229 | $2,799 | FH |

| GALLOP GREEN | $8,580,000 | 3272 | $2,622 | FH |

| SCOTTS HIGHPARK | $7,800,000 | 3466 | $2,250 | FH |

| LEEDON RESIDENCE | $7,450,000 | 2659 | $2,802 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARC ROSEWOOD | $668,000 | 431 | $1,551 | 99 yrs (2011) |

| MELOSA | $682,000 | 431 | $1,584 | FH |

| PARC ROSEWOOD | $692,000 | 527 | $1,312 | 99 yrs (2011) |

| JUPITER 18 | $710,000 | 420 | $1,691 | FH |

| EASTWOOD REGENCY | $765,000 | 474 | $1,615 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| BOTANIC GARDENS VIEW | $4,128,000 | 1755 | $2,353 | $3,265,700 | 26 Years |

| GALLOP GREEN | $8,580,000 | 3272 | $2,622 | $2,980,000 | 7 Years |

| THE SOVEREIGN | $6,200,000 | 2637 | $2,351 | $2,700,000 | 8 Years |

| MAPLE WOODS | $5,000,000 | 3003 | $1,665 | $2,604,800 | 26 Years |

| MAPLE WOODS | $3,820,000 | 1787 | $2,138 | $2,470,000 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE ORCHARD RESIDENCES | $10,250,000 | 2852 | $3,593 | -$1,750,000 | 14 Years |

| THE SAIL @ MARINA BAY | $4,500,888 | 2077 | $2,167 | -$68,512 | 18 Years |

| ECO | $1,300,000 | 850 | $1,529 | -$38,130 | 12 Years |

| WHISTLER GRAND | $820,000 | 441 | $1,858 | $24,800 | 4 Years |

| VIBES @ KOVAN | $1,000,000 | 786 | $1,273 | $30,000 | 2 Years |

Transaction Breakdown

For more stories about home ownership experiences and real estate, follow us on Stacked.