HDB Just Made It Easier For Young Couples To Buy Flats: But Not Everyone Is Happy

-

Ryan J

Ryan J

- March 28, 2025

- 5 min read

- Leave comment

5 min read

5 min read

You would think that HDB easing income assessment to buy flats, for younger couples, wouldn’t be too controversial a change. However, there’s been a flurry of negative comments online, and questions about whether we’re making young Singaporeans commit too soon, avoiding real issues, creating openings to game the system, etc. In some ways, the response to the issue also reflects the current mood, and concerns about our public housing system:

What are the changes that have happened?

From July 2025, the income assessment method for young couples buying BTO flats will be tweaked. From that month on, couples where at least one partner is a full-time student or NS Man can opt to defer their income assessment for an HDB loan.

Deferred income assessment allows flat buyers to postpone the evaluation of their income for issues like loan limits and grants. This assessment, which is usually done at the point of flat application, is pushed to the time they actually collect their keys.

This matters especially for young couples because – before they’ve joined the workforce – they usually can’t qualify for the required loan.

Note that deferred income assessment is not in itself a new policy. It’s just that prior to this change, both applicants had to be full-time students or NSFs, or had to have completed their studies or NS within the past year to get deferred assessment.

By making this tweak to the policy, HDB broadens the number of young couples who can apply for their flat while still in school, serving NS, or are otherwise in transition to the workforce.

The intent by the government is to help more Singaporeans to settle down earlier, without being forced to compromise on space. However, it’s important to keep in mind that deferred income assessment is not a guarantee the applicants will get the flat: it simply lets them apply earlier, on the assumption their future income will be higher.

What are the most immediate implications?

1. Earlier access to larger flats

The lower the income, the lower the maximum loan quantum possible. This is due to the Mortgage Servicing Ratio (MSR), which caps the monthly loan repayment to 30 per cent of monthly income.

A student couple earning $3,000 per month, for example, are restricted to monthly loan repayments not exceeding $900 per month. This would restrict their total quantum to somewhere around $200,000, which may be plausible for a BTO 3-room flat.

(Note: This excludes the minimum 25 per cent down payment for the loan)

Assuming it increases to $5,000 a month when they join the workforce, this sets their MSR limit to $1,500. This allows them a maximum loan quantum of $330,000, which might make a 4-room flat possible.

2. Encourages earlier home ownership

One intended effect is that young couples will apply for and possibly get their homes sooner. This is in alignment with the overall direction to encourage more families and perhaps a higher birth rate.

This does assume, however, that a lot of young couples are eager to dive into home ownership. We can’t guess how many may be more prudent or hesitant, due to the financial commitment.

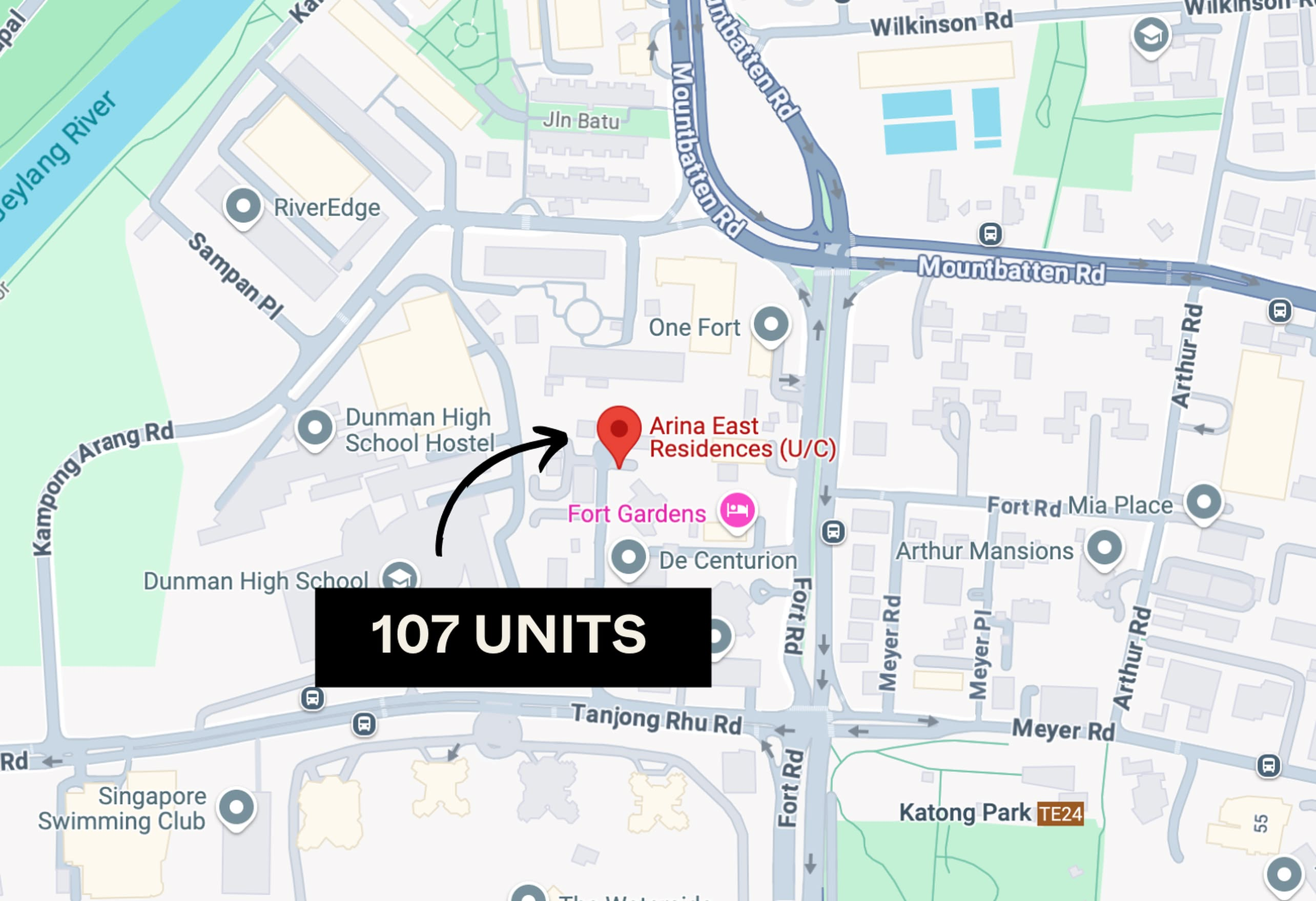

3. A possible boost in Prime and Plus flat demand

If there’s a shot at getting a desirable Prime or Plus flat, and they can get it early, some couples might well go for this. It will probably come as an annoyance, however, to older interested buyers who now have added competition.

And again, we don’t know how many young people will be eager about the financial commitment, which is even steeper for Prime and Plus flats.

4. Might ease resale demand

If young buyers choose to go the BTO route because of this, it could reduce some of the demand for resale flats down the line. This is a bit speculative, but it does seem possible that fewer Singaporeans will end up waiting till they’re much older, and then rushing for an already-completed flat to make up for lost time.

Why are some complaining about this?

So far, we’ve seen some of the following points being raised:

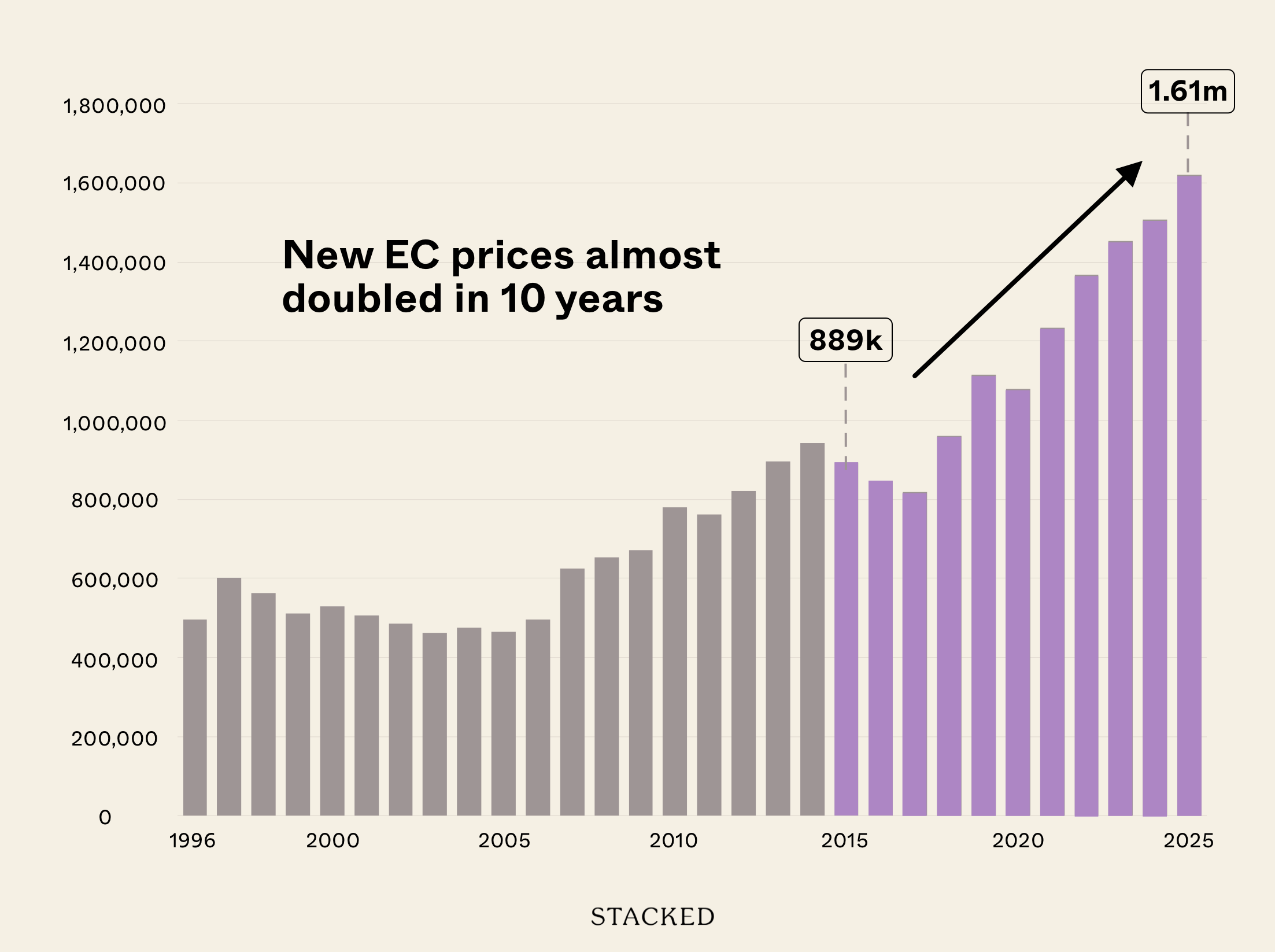

1. This move fuels demand without being a real solution

Many commenters argue that instead of increasing supply to make housing affordable, HDB is instead boosting demand by letting people who aren’t yet earning (e.g. students, NSFs) enter the market. This could drive prices up further, especially for BTOs in desirable areas.

A quote from Reddit user awkwardlyaardvark says:

“Instead of increasing supply to make housing more affordable, they are driving up demand by adding more people (who are not yet income earners) to the pool. How does this solve -any- existing problem? It seems to me this will create new problems and exacerbate current ones.”

2. Some Singaporeans feel this is a debt and affordability issue

This view was more common on Hardware Zone, where some expressed the view that this move would lead to over-leveraging, as young Singaporeans would grab at properties which stretched affordability to the limit.

User Shion said in succinct Singlish: “Pls la, end up all choked by long term loans nia.”

User louisoh also claimed that this is a way to keep Singaporeans “on the hamster wheel as long as possible,” because if there aren’t people in enough debt, “who will work?”

Another user, Roburn questioned if it “means houses are getting more expensive, to the extent that applicants cannot afford based on salary, during the point of application.”

3. Concerns about gaming the system

FlimsyAmphibian5162 said that Dual Income, No Kids (DINK) couples could exploit this to their advantage:

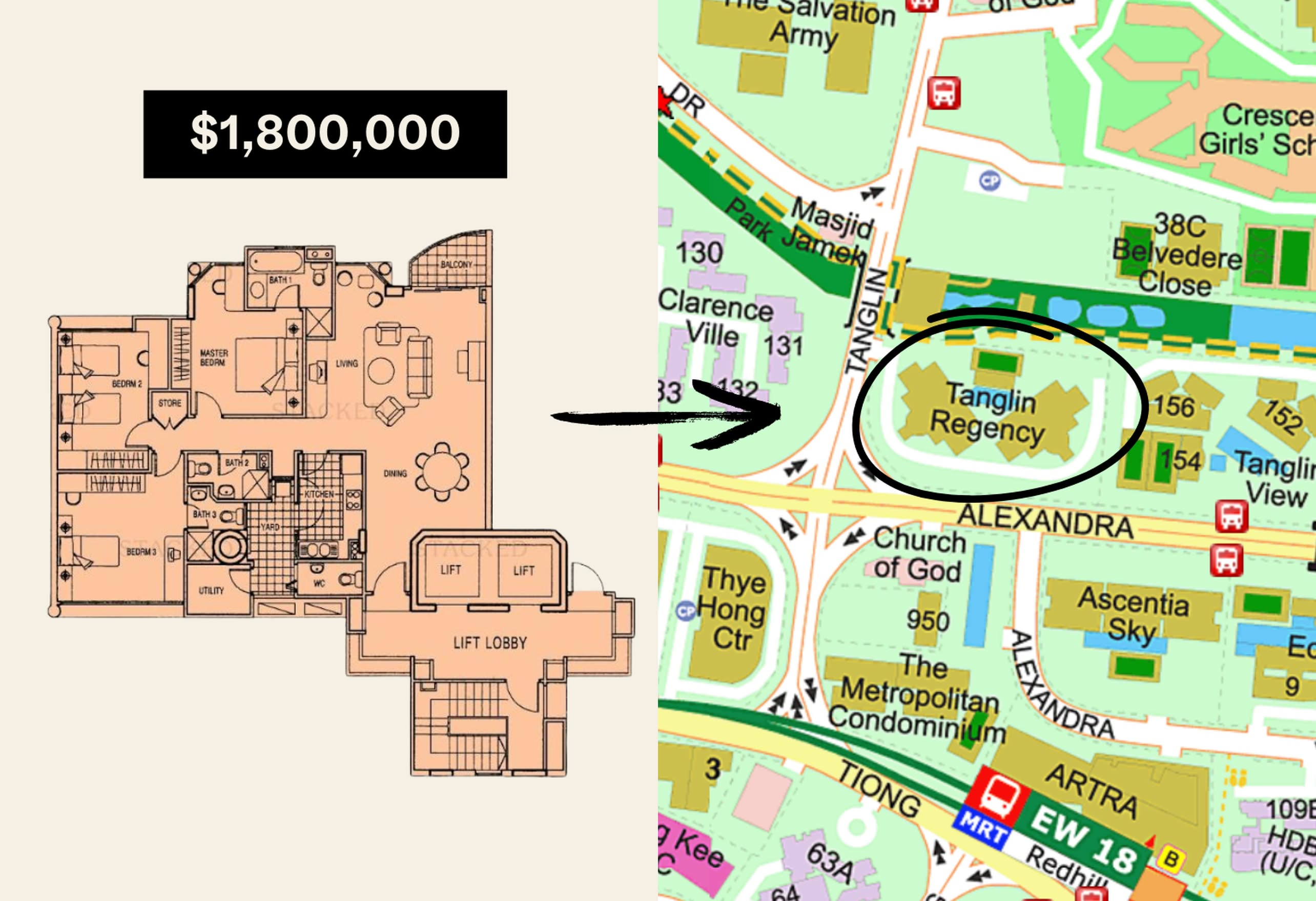

“HDB, are you sure you are helping young couples who intend to have kids or are you helping young DINK couples who intend to game the system to make a million dollar profits by applying for a city area BTO they can’t afford while they’re still studying in Uni?

What’s gonna happen is young Uni couples are gonna apply for 5rm city area BTO with the deferred income scheme. Doesn’t matter if they exceed $14k income cap by the time they move in cuz they’ve secured the flat while they were a ‘poor student’. 5 years later, without popping out a single kid, they sell their $1.5m HDB 5rm.”

But note we don’t think they’ll be selling a central area flat “five years later,” since the Prime and Plus flats have 10-year MOPs.

Finally, there’s the usual accusation of General Election tactics

As is typical every time elections come around, policies will be associated with ulterior motives. We suppose this move might be popular with the “just started adulting” generation; but we’ll leave it up to you whether this is a political tactic or not!

Our opinion, as it stands, is that not a lot of people are actually affected by this. In our experience, those still young enough to be students or in NS have other concerns besides owning a home – most tend to stay with parents or rent for some time yet, before they start looking for a flat.

One possible consideration here is to better target this policy, based on subscription rates. For example, we might make this deferred assessment possible only at BTO locations that are not likely to be oversubscribed; this could avoid intensifying competition.

For more news and homeowner experiences in Singapore, follow us on Stacked. If you’d like to get in touch for a more in-depth consultation, you can do so here.